With the rise of exchange traded funds you can now invest in the financial markets of many nations around the world with practically the press of a button.

And often there are specific national stock markets that are going up much faster than the United States stock market has been doing, which is not really going up anymore.

I invest in a basket of exchanged traded funds myself using technical analysis and various technical indicators to help me decide which ones to buy and which ones to sell.

So what about India?

There is a lot of political news going on there that is drawing people’s attention.

In 2014 India elected Narendra Modi to be its Prime Minister.

One thing he did is to wage war on red tape and regulations and open up his country to more foreign direct investment.

In fact in 2014 the foreign money flowing into India increased by 61%.

This made India overtake the United States and China to become the top place in the world as the number one destination for direct foreign investment.

Yes the economy in India is that large.

Part of this was about Modi’s initiative called Make in India he announced in 2014 to turn India into the world’s number one manufucturing hub.

Here is a report by CNN on this program:

So while the economy on India is growing and the nation is expecting to grow more there are signs of international tensions that scare some people.

India is considered to be one of the “BRIC” nation’s that will fuel the global economy, but there are cracks in the “BRIC” structure.

India has a very troubled relationship with its neighbor Pakistan and Modi has conducted surgical military operations against Pakistani targets linked to terrorist groups.

This year India launched an operation in the Kashmir that resulted in the deaths of hundreds of civilians and some world anger and hand ringing on CNN.

This spilled over into a recent BRIC summit.

Journalist Andre Vltchek who covered it said that “it appears that there is a change of mood in New Delhi. Prime Minister Modi is finally showing interest in participating in this organization but the question is to what extent this is going to be political because Prime Minister Modi is talking about hunting business opportunities and he is a very strong pro-Western leader.”

“We have the Issue of terrorism also. At this moment India is constantly talking about the terrorist threat and the need to deal with it but in recent weeks India has performed extremely brutal actions in Kashmir, where more than 100 civilians were brutally killed. So is this terrorism or is this occupation? There is a lot of questions that have to be answered in the upcoming hours,” he said.

Meanwhile the United States slapped a travel ban on Modi back in 2002, because he played a key role in some religious riots.

But that ban has since been lifted even though Modi remains a figure of derision in the United States as India is also seen a potential regional competitor.

But is India a good investment right now?

Well from a valuation metric I use the cyclically adjusted P/E ratio to determine whether a national stock market is cheap or expensive.

The India CAPE is at 18 so it’s expensive.

How about the chart?

Well here is IFN, which is the India Fund ETF that trades on the NYSE:

Frankly right now the Indian stock market and IFN are simply going sideways.

I have no way to tell if that sideways pattern is the making of a giant top or a pause before a big move up.

But since the market is overvalued there is nothing exciting about trying to invest in it.

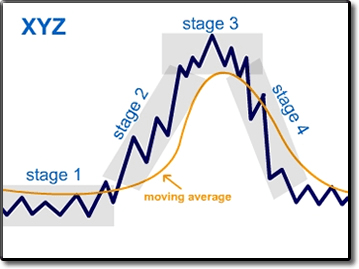

What I prefer to invest in are markets and sectors that are cheap and are coming out of a stage one base or at the start of a stage two bull market.

The gold price chart is in this situation and so are gold stocks.

If you are new to this website then you need to get on my free email update list for more info. To do that just scroll down.