My top mining stock pick for this month is revealed to you on this page. We go through hundreds of stocks a month and look at both the big cap and small cap junior miners to find our top play for the month.

We then release this information in our free PDF report.

To get this report all you need to do is subscribe by scrolling below or going to the right sidebar and hitting the graphic.

I did an interview about the types of investing I am doing in the precious metals world early in 2016. Sometimes I look at technical chart patterns first and other times I look primarily at company fundamentals and stories. There are times I even invest in insider deals with private placements as I explain in this video.

Should You Buy Gold Stocks?

Yes you should buy gold stocks even though they are very volatile and prone to pullbacks and such a pullback is going on right now.

I’ve been trading and investing in the financial markets now since before 1999 and even ran a hedge fund for a few years. I’ve traded many sectors in the stock market and in markets all over the world and there is nothing like gold stocks. And I can help you find the best ones to buy when the time is right.

Gold stocks make huge moves. The HUI gold stock index has had years were it has fallen fifty percent and years were it has doubled value. When you are positioned on the right side of these moves there is nothing like it. The mining stocks tend to move exponentially up and down with the price of gold so are a great way to leverage some of the money in your brokerage account.

I know right now the TV media is negative on gold stocks, because they made a peak in 2011 and went into a vicious bear market that ended in 2014. But all bear markets and big corrections come to an end and the gains that are going to come are going to take even the most bullish of people investing in gold by surprise when the next big rally starts.

Yes that means that now is the time to thinking about how to buy gold. Buying some physical gold does make a lot of sense and so does putting some of your brokerage account in a gold etf and some in gold stocks when the time is right to get more bang for your buck. You can even get physical gold ownership in your retirement account with a gold ira rollover safety plan.

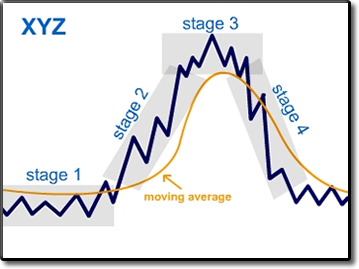

If you look at a chart of gold you’ll see why. You need to understand the big trends. I divide the market cycle up into four simple stages – a stage on basing phase, stage two bull market, stage three topping phase, and a stage four bear market. In this graphic the moving averages are the 150 and 200-day moving averages.

If you look at a chart of gold the message is simple. We saw a stage four bear market that ended in 2015 with a stage one base into the first few weeks of 2016. That basing lead to a massive and now the HUI is in a full blown bull market.

This is exciting, because most bull markets last three to five years and the first year often begins with a nonstop rise.

During big bull markets like this the 150 and 200-day moving averages act as support.

You will see pullbacks to them from time to time to provide for excellent entry points.

Take a look at the HUI miners index and you can see the start of the stage two bull market that began in the first 60 days of 2016.

Right now the HUI is pulling back. At the time of this post the pullback does not appear to be over so we are monitoring the situation for a coming buy point.

How to Know the Right Gold Stocks to Buy

To buy gold stocks in your brokerage account you first need to diversify in several of them that way you control your risk.

Then you need to understand that there are basically three types of mining stocks.

First you have the big cap mining stocks that produce most of the gold in the world and are giant corporations. They are the big producers.

The most well known of these big cap stocks are Newmont Mining and Barrick Gold. Let’s look at the latter as an example.

Barrick Gold Stock

You can see that Barrick Gold, which trades with the symbol ABX on the New York Stock Exchange, had a big drop in 2012 and in the first half of 2013 and then went into a stage one basing phase in 2015.

This phase marked the prelude to a new bull market. Once ABX went through the resistance of it’s 200-day moving average it exploded higher in 2016.

It will have its pullbacks as it is doing at this moment, but it now should go up for several years. The gains from stock appreciation will be enormous. Barrick also pays a nice dividend. So we are watching for a coming entry point.

Some of the large cap producers pay dividends of over 3% a year right now. That is one of the nice things about the big producers – not only will their stocks go up in the next bull cycle, but they will give their investors some nice income.

Now there are small junior mining companies you can invest in too that are either emerging producers which are developing a property and mine that they plan to put into production or else have a small mining operation that they are going to expand.

These stocks are more risky since the companies are smaller and often have to do stock offerings in order to raise revenue, but the right ones can go up even more than the big cap producers. They are the ones that are really set to expand their production and are currently trading at a low valuation.

These are stocks that are growth stocks that you can invest in at a low valuation. In the stock market those type of investments often translate into huge gains.

Below this category of mining stocks you have the pure exploration company. These are companies that do not produce any gold at all, but are drilling properties to explore them in the hopes of finding a worthwhile deposit to mine. If they find one they’ll either do a deal to become an emerging small cap mining stock or look to merge with a big player.

Most of the exploration companies never find anything viable, but the ones that do provide tremendous returns for their shareholders.

I invest in mining stocks and provide my readers with many stock picks and actionable investment ideas. I also have a system to pick out stocks I call the Two Fold Formula, because it comes both fundamental and technical criteria, that can help you no matter what sector of the stock market you invest in. Get on my email list for my next top stock pick by scrollinig below.