Now I’ve moved to doing weekly updates, instead of daily updates, since the stock market made its last peak in February. I was expecting the market to enter a sideways trading range, with a chance it could retest it’s lows. Now that looks likely. But, in this environment, there are lots of temporary gyrations and fake moves and it’s not worth commenting on every single thing that happens. For instance, last week, the Fed Fund futures shifted by Thursday morning to price in a 75% chance of a 50 point rate hike at the next Federal Reserve meeting at the end of this month. By the close, on Friday, those odds completely collapsed and now are back to pricing in a 25 point hike instead and a chance of no hike at all.

So, the earlier move for a 50 point hike was a fake.

Some moves and news items are important and meaningful.

Last week, we saw the first giant bank failure since 2008 in what was the 18th biggest bank in the United States. I’m talking about Silicon Valley Bank, which specialized in lending to tech bro companies, including crypto companies that make no money. The stock market dumped on this news and I saw people making wild predictions and claims on social media about it. One person on Facebook in my area was claiming that Wells Fargo was going to collapse and people should take all their money out of their bank to buy crypto coins for safety. Of course, Wells Fargo is fine and crypto coins are COMPLETELY USELESS in this environment. On Friday, Bitcoin dumped worse than stocks did, while gold went up, to show you what really works in times of financial trouble. The idea that buying crypto coins in response to a bank lending to crypto companies going under makes zero sense. History shows that when the stock market merely corrects crypto crashes.

The problem is people cannot stop trying to speculate in garbage to get rich quick, when they need to be thinking about being more defensive in this market environment, and if you try to tell these people to do something else they just tune you out and go look for a crypto guru on Ticktok or Instragram to tell them what they want to hear. The social media world is their world.

Silicon Valley Bank is not the only bank that is tumbling. Signature Bank, which is another bank lender specializing in crypto companies saw it’s shares crash over 22% on Friday alone. You can watch this video of it’s CEO to see the type of complete technobabble nonsense the people running these banks talk.

Starting around the 1:30:00 mark, $SBNY Chairman, Scott Shay, decides to recite the “greed is good” monologue from Wall Street (1987). Then proceeds to talk about trust on that blockchain. You can’t make this shit up. @AlderLaneEggs $SBNY $SBNYQhttps://t.co/atmx17Lb3z

— Not Tiger Global (@NotChaseColeman) March 5, 2023

Thankfully, only a few banks lend to crypto companies or to tech bros with unicorn start ups that have no revenue.

We are not headed for a financial crash like 2008. As I have been saying, over and over, we are in a secular bear market, much as what was seen in the 1970’s, typified by high inflation. It’s all a result of a decade of zero interest rates policies, after 2008, that spurred financial bubbles throughout the economy, which destabilized the financial system. No one cared as long as the stock market went up, and the masses cheered it all, including the payments they got after the March 2020 lockdowns, but now we are paying the price with systemic inflation.

In secular bear markets (10 year plus sideways to down cycles) you get shorter term (1-3 year) cyclical cycles.

This is what that looked like from 1966 to 1982.

It appeared to me in January that we were starting a cyclical bull market. Internals of the market turned up and many sectors in the US stock market came a live in a powerful rally, which spread to the semiconductor sector by the end of January. There are still things outside the US stock market that look good, but last week’s market action derailed this cyclical bull market for the US stock market.

Only time can get it back on track – and that’s if it does.

It’ll take several months of stock market action to see if it can hold up.

Here is what Walter Deemer is now saying.

Today was an 88.5% downside day, which follows yesterday’s 93% downside day. Will definitely take a 90% upside day now, IMHO, to sound the “all clear”. Monday? Next month? We will only know in the fullness of time…

— Walter Deemer (@WalterDeemer) March 10, 2023

And here is a chart of the S&P 500.

Deemer’s work shows that the market should hold up and rally in a few months, because his thrust indicator, based on internal market action, has never failed before.

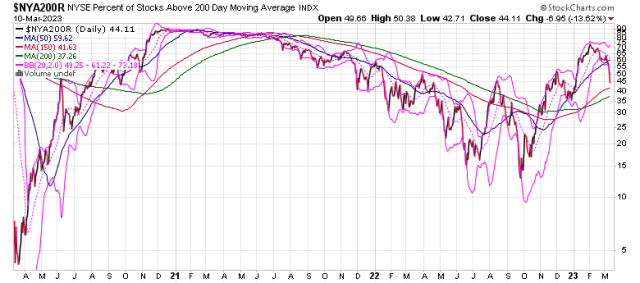

I would also say that in the bear markets I have seen, since the 1990’s, never have the bear market rallies taken the percentage of stocks inside the NYSE above their 200-day moving average up above 75%. Such internals strength only has happened in bull markets.

If the bullish thrust indicator fails for the first time it would mean that we are in a trading environment that is different than what it has been in the past.

What would be different?

Well, today’s markets are dominated by hedge funds using trading robots and algorithms. It’s possible that these funds actually traded based on the internal indicators. For instance, maybe they bought when the percentage of stocks on the NYSE above their 200-day moving average fell below 15% then kept buying and buying until they simply sold and began to short when the indicator got to 70%.

Now let’s put on the bull cap.

Let’s say the odds are 50/50 that the S&P 500 will still end up breaking through its February highs to generate a new rally up before the end of the summer. Well, this still isn’t great from a risk/reward standpoint when I am just looking at what was a potential 18% gain to the January 2021 market high for the S&P 500 last weekend. You basically risk what you stand to make now, when as an alternative you can get a guaranteed 5%+ return over the next 12 months in Treasury bonds and CD’s.

That may not bother people who are just holding US stocks forever and look to constantly average down, but it is a problem, though, for small local and regional banks.

You can buy a 3-6 month Treasury bond now and get over 5%. Most smaller banks are paying less than that on their CD’s, so people are taking money out of them and just putting them into Treasury bonds where they can make more money. At the same time, most banks piled into Treasury bonds back in 2020 when rates were zero. Bonds go down in value when yields go up, so the value of the bonds that they own has been falling. The result is that the balance sheets for banks have been shrinking.

On Friday, I sold most of the US stocks I bought in January.

I didn’t do this because Silicon Valley Bank failed, but because the shares of regional banks across the US dumped. The IAT regional bank ETF fell 20% in three days.

It is hard to have a bull market in the US stock market when its regional bank stocks dive like this.

This doesn’t mean we headed for a 2008 banking meltdown.

You see, in the 1970’s bank stocks were among the worst performing stocks of that decade.

They actually saw their revenues grow strong as rates went up, but the assets they held on their balance sheets (like Treasury bonds) went down and down in value and so that drove their stock prices down, but their bear action did not forecast a banking crisis.

This has been a tough market since the US stock market averages rolled over thirteen months ago.

To beat the market you have to focus on sectors and even other assets classes and other markets beating the performance of the S&P 500.

Foreign markets are doing that.

And so is gold and silver, even though they both pulled back in February with the stock market.

Take a look at the gold/spy relative strength ratio.

Gold has been a better investment than the S&P 500 and Nasdaq since New Years of last year and it’s simply going to continue to be so going forward.

On Friday, the gold/spx relative strength popped up and it is in a position now to breakout of its range in the coming months.

If it does that, look to see money shift out of stocks and into precious metals.

This week we have the February CPI report due on Tuesday.

It’s not likely to show much of a decline from the last report, but the one in April is.

It may be that we don’t really get much “good” news in the financial markets until that April report.

Last weekend, Fed Fund futures were looking at the end of this rate hiking cycle happening in July. Now they are saying June is more likely to be that moment.

It is the end of that rate hiking cycle that is going to be the positive catalyst for the next big rally in gold and silver and each week that goes by takes us closer to that event.

Only time will tell if it will also help the stock market make a run to its all-time highs, but last week reduced the odds of that positive outcome.

Personally, I like foreign markets and metals better now as investments than the US stock market. I consider my entry into some US stocks in January as a failed trade, after last week, and so sold almost all of the stocks I bought then, while I continue to hold most of the things I bought in late October/November (materials stocks, metals ETF,s foreign market ETF’s, mining stocks), and have a little over half of my money in short-term CD’s at the moment. Everyone has a different situation and how you invest depends on many factors, including your age, how much you have already made in the markets, and so on, but diversification is really important in this market environment.

Let’s see what happens this week – things dumped so bad Thursday and Friday that hopefully there can be some sort of bounce.

Hey, I’d be happy if I sold on the bottom of this move, but it’ll take weeks to know.

To get my free stock trading updates click here.

-Mike