Something huge is now happening in the commodity markets that no one has taken notice of at all. Now the obvious is that every month it seems as if there is an individual commodity that is taking off and soaring. Last month it was natural gas prices and the month before that it was uranium. Now this month it is the price of cotton that is taking off like a rocket, as you can see from this chart.

Last year the price of cotton crashed in the spring to make a secular low, which marked a bear market bottom that had been going on for over a decade. This happened at the same time that the price of oil went negative in the futures market and was an across the board trend in other agriculture and “soft” commodities.

But, here is what is happening that is breaking a trend really going back to 1980.

Seasonally cotton would rally into the summer and then peak and then go all the way back down to its lows of the year and repeat this pattern every year.

In other words cotton would typically peak in the summer and dump into the end of the year to make a winter buy point for traders to play the next summer rally, but if they didn’t sell on the rally they’d get crushed.

In fact, oil prices typically would do something similar – peaking in the summer and declining into Thanksgiving.

This was a consistent seasonal pattern across the board for most commodities for over thirty years.

And now that pattern is not only being broken in cotton, as it is soaring now, but also oil itself. Instead of having a decline into Thanksgiving, this year the price of oil basically went sideways in a narrow range and then turned up months before it usually would.

This is a simple sign that we are in a new strong secular bullish trend for commodities that should cause all traders to throw out their rule books of the past.

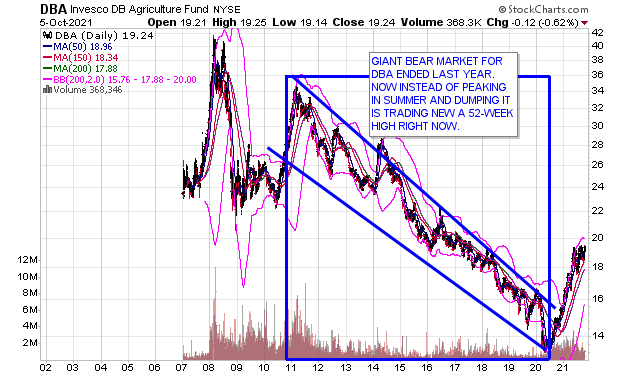

Commodities are showing us that they are in a secular bull trend and secular bull trends don’t just last a few months, but last for years. The DBA ETF is the largest ETF for soft commodities.

I don’t own cotton futures or a cotton ETF myself, but I do have a core position in the DBA ETF in my IRA and main account and also like commodity related stocks, such as my top stock pick for this month, which is a value zinc/lead/silver player. You can find out about it in my Monday post on it here.

I believe that commodities are a necessity for people to have some sort of position in if they are a serious investor in these markets. We are not in the markets of 2020. Your Cathie Woods style stocks were the plays of the fourth quarter of 2020, they are not the type of stocks to hold for the next decade. We have reached peaked Robinhood and that game is over. No one cares about Zoom anymore, in fact most people avoid Zoom calls now who can.

-Mike