We have seen a long drawn out consolidation phase play out for gold and silver since August of 2020, which has led to a September dip in both. This has had a negative impact on the price of many mining stocks, but is causing some to become so oversold and undervalued that they have simply stopped falling despite the falling prices in most mining stocks. This tells me that they are simply sold out and so oversold that large shareholders believe it to be foolish to sell and those that follow the industry see the stock prices as bargains to cheap to pass up.

I think it likely that we’re going to see overall churning continue for a few weeks in gold and silver with the next rally starting once the Federal Reserve announces its reduction in QE buying. It’s traders getting ahead of the news and its now negatively impacting the bond and stock market too, as I discussed with Ike Iossif of marketviews.tv last week.

I believe this sets up a great buying opportunity this month to buy a few small cap mining stocks that already stopped dropping to signal that they are deep value plays on discount. The top stock at the top of my list, which I own a position in, is Vendetta Mining, which trades as VTT on the TSXV and VDTAF on the US OTC market.

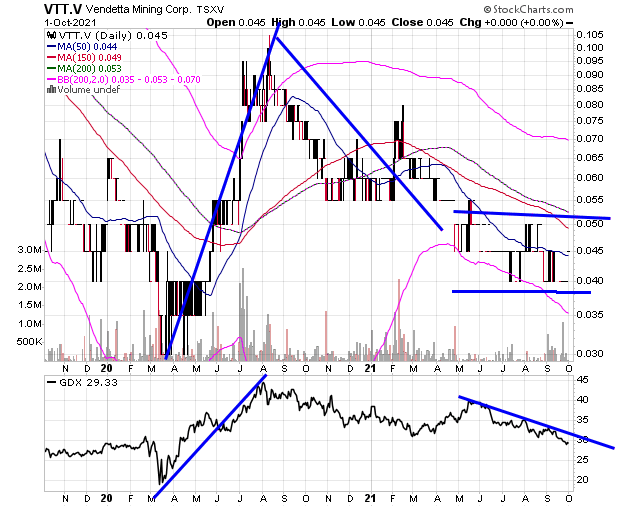

Take a look at the chart.

VTT fell all the way down to 3 cents a share when the covid breakout crashed the stock market in 2020 and then rallied all of the way up to 10 cents a share, at which time it peaked out at the same time the GDX mining stock ETF did.

What is key, though, is it stopped falling in July even though the GDX has continued to fade into the end of September. While the GDX fell down to below $30, shares of VTT traded in a range of 4-5 cents. The stock became so cheap that shareholders stopped selling despite the continued weakness in the GDX and the metals markets.

It’s a sign that it is a strong buy now in my view and will likely rally strong once the current consolidation pattern ends in the metals market. It’s best to buy ahead of that moment, because you can’t really predict when it will come, but I do think there is a good chance it will start after the Fed announces its QE reduction program, something it is now on track to do in the first week of November.

So, here is the deal with Vendetta.

It has proven properties that can be put into production to turn a profit and is trading with a market cap of roughly $9.3 million USD. Most unproven pure exploration stocks get to market caps over around $25 during rallies in the metals markets.

Vendetta Mining’s big property is the Pegmont Project in mining friendly Australia.

The Pegmont Project is an advanced stage Lead/Zinc mining property that is 100% owned by Vendetta Mining. The property has a preliminary economic assessment, which has been completed for it and summarized here.

Notice the projected silver production.

This is part of a slide of a complete PDF presentation for the company you can find here.

To give you a short version of what is happening: mining companies at this stage tend to set their sights on partnering with a larger company to finance putting a property like this into production or planning on finding a way to finance such an operation themselves, but first they often engage in more drilling to prove up more resources for the property. That increases its value to help it make an even bigger deal and often will drive up the share price.

This summer Vendetta raised some money to fully fund a drill program for the property and on July 15 issued a press release titled Vendetta to Commence Zone 5 Drilling at its Pegmont Lead-Zinc Project. This is a ten hole drilling program.

“A two hole program was completed late 2020 as part of a Queensland Government Collaborative Exploration Initiative (see News Release August 12, 2020), one of those holes PVRD196, located in Zone 5, intersected 8.42 m @ 7.07% Pb, 5.98% Zn and 9 g/t Ag between 161.10 and 169.52 m down hole, outside of the current Mineral Resource, with an estimated true thickness of 7.0 m. The objective of the upcoming ten hole program is to expand the mineralisation centred around the PVRD196 intersection, testing a strike length of approximately 500 m,” reads the press release.

Here is what the property camp looks like.

I believe that at this market cap and stock price Vendetta is a deep value play. The fact that the stock stopped dropping in July despite the continued decline in metals prices into the end of September has me convinced that is in a good buy spot right now.

Disclosure: Mike Swanson owns shares of Vendetta Mining. Because it is a small cap stock with a market cap of less than $100 million he has put himself in a trading blackout on the stock and will not buy or sell a share of it for at least 30-days from the date of this post (10/04/2021). Wallstreetwindow.com, is owned by Timingwallstreet, Inc., which was compensated by a third party (Leadgopher LLC DBA Pinnacle Ad Network) to conduct an investor awareness advertising and marketing campaign for Vendetta Mining for 30 day during the month of August, 2020. This third party paid Timingwallstreet Inc., $10,000 to produce and disseminate this and other similar articles and send traffic to them through paid advertising campaigns during the month of August, 2020. This compensation should be viewed as a major conflict with our ability to be unbiased, more specifically: This communication is for entertainment purposes only. Never invest purely based on our communication. For more on trading risks read our policy statement by clicking here.