The Bureau of Economic Analysis released its latest personal consumption expenditures price index (PCEPI) estimation on February 24. The PCEPI is the Fed’s favored measure of inflation. The latest release points to more interest rate hikes in the future.

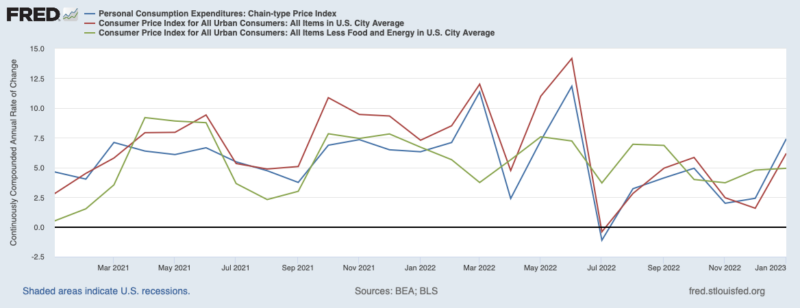

PCEPI grew 0.6 percent in January. This rate puts the 12-month PCEPI inflation rate at 5.4 percent, still significantly above the desired 2-percent level. For the two previous months, November and December, the 12-month PCEPI inflation rate was 5.6 percent and 5.3 percent respectively. Unlike other inflation measures, such as those based on the consumer price index (CPI) and core CPI, PCE’s 12-month inflation rate shows no clear sign of a downward trend. Given the Fed’s historical pace of increasing its interest rate target, and comments from the last FOMC meeting, it seems likely that the Fed will push interest rates even higher than they had previously projected.

Figure 1. PCEPI, CPI, and Core CPI Monthly Inflation Rates, January 2021 – January 2023

Despite the last PCEPI number, it is not clear that further rate hikes are the right way to move forward. Two factors contributed to inflation over the past two years. First, supply constraints related to the pandemic and corresponding restrictions on economic activity and, later, Russia’s invasion of Ukraine pushed prices up. These supply constraints have largely been resolved at this point. And, to the extent that there are lingering supply-side issues, there is not much that monetary policy can do about it. Indeed, using monetary policy to offset supply-induced increases in prices will result in further decreases in output, making us even worse off.

The second reason prices rose rapidly over the last two years is the surge in nominal spending made possible by exceptionally loose monetary policy. Whereas temporary supply disturbances have temporary effects on the price level, a nominal-spending shock results in permanently higher prices, unless they are offset by monetary policy. Given that supply disturbances have largely run their course, loose monetary policy accounts for much of the difference between the price level today and where it would have been had the Fed hit its 2-percent average inflation target since the start of the pandemic.

While it is true that loose monetary policy pushed prices up, it doesn’t follow that the Fed should continue tightening to bring prices back down. It is important to remember that monetary policy operates with a lag. The 12-month growth rate of the M2 money aggregate has fallen consistently since August 2021. In December 2022, it was negative 1.3 percent. Just as the increase in M2 growth pushed inflation up, the reduction in M2 growth will see inflation decline. But it doesn’t happen overnight. And it is certainly possible that the Fed has tightened sufficiently already.

If the Fed has tightened sufficiently already, then it should not continue tightening just because inflation has not yet come down. Instead, it should wait to see the effects of its policy play out. That it might not do so has some analysts worried. They think the Fed is likely to overreact, perhaps in an attempt to compensate for its late response.

Those worried that the Fed is poised to overreact can point to the inverted yield curve as support. Measured as the spread between the 10Y and 3M treasury rates, the slope of the yield curve is around negative 1.10 today. A yield curve inversion is commonly taken as a sign that a recession is more likely than usual. And today’s yield curve is inverted to a greater degree than that of the late 1980s, early 2000s, and the 2008-09 recessions.

On one hand, we have inflation indicators that are not falling as fast as the Fed would like to see. On the other, some signs point to an overreaction by the Fed that challenges expectations of a soft landing. Fed officials will likely continue tightening, and to a greater extent than previously projected. Their overreaction will not undo the damage of acting too late. It will make matters worse.

THIS ARTICLE ORIGINALLY POSTED HERE.