The action in gold, silver and the mining stocks is continuing to look more positive after they all put in lows last month ahead of the Federal Reserve’s November meeting at which they announced phase out plans for their QE bond buying program.

First, let’s take a look at the chart of gold.

Gold actually made a higher low in October, but at the start of the month it began to outperform the US dollar index. It is now trading with resistance at the $1840 level, but I see no reason to think that it won’t break that before year end. It looks like a pause below that level and then a breakout is what is coming.

The GDX gold stock ETF has already rallied to almost take back half of its losses from May, and is outperforming the price of gold as the GDX/GLD ratio on the bottom of this chart shows.

It looks like the $34 area is acting as a short-term resistance point for the GDX ETF.

I own the GDX in my IRA and these two big cap mining stocks in my main account that are in an interesting position now.

Although I already own FNV, I think one could buy it here with a stop loss below $140.

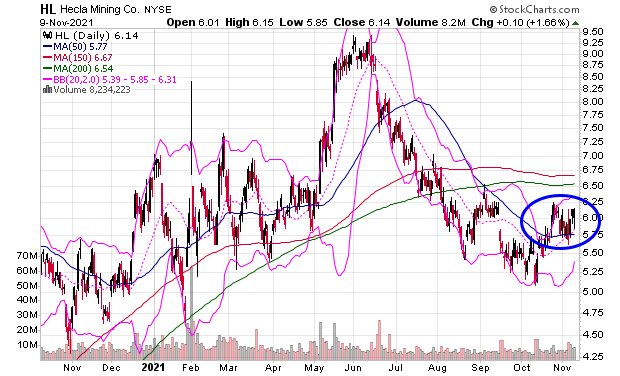

Also check out silver miner HL.

One could buy HL here with a loss below $5.50 for a decent entry point. $6.25 is currently resistance on it and it appears to be consolidating between these two price points now.

-Mike