Today we have a Federal Reserve meeting that will likely dominate the financial news for an hour or two even though everyone knows that the Federal Reserve is not going to raise rates today, next week, and for the rest of this year. It will be a long-time before they ever do again and one day yield control will begin. That’s why gold outperformed the stock market last year, the US dollar is sagging, commodities are coming alive and real estate prices nationwide have gone up 10% since the March stock market collapse.

Call it the 1970’s show. But there is also an air of 1999 going on as yesterday Gamestop went up over 95% again and then soared more in afterhours after its wild Monday run.

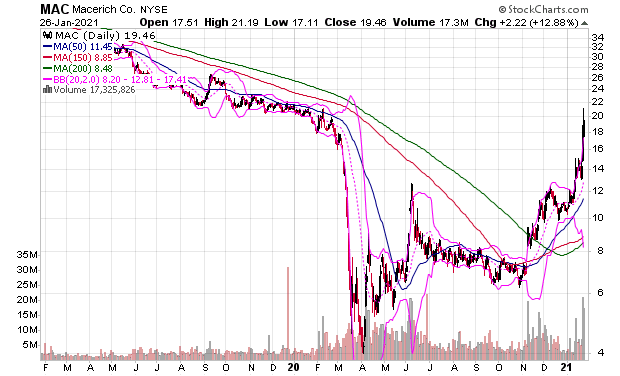

I talked about this Gamestop stock yesterday and how what it essentially is an epic short squeeze forcing it higher. I also noted how one stock in my account went up 25% on Monday too and it went up again yesterday over 12%. It has an over 55% short position. This is the stock.

Macerich is a real estate investment trust that invests in shopping centers. It is the third-largest owner and operator of shopping centers in the United States. As of December 31, 2019, the company owned interests in 52 properties comprising 51 million square feet of leasable area. I bought it for the dividend and because it’s a REIT. I wanted to take a position as the year started in the REIT sector so did so by buying a basket of stocks. I wasn’t looking for a short squeeze and this stock has gone up too high to see this as a great entry point.

There are lots of stocks in the sector that are still consolidating, though, and so is the RWR REIT itself.

RWR pays a 3.79% dividend. I own a position in it.

-Mike