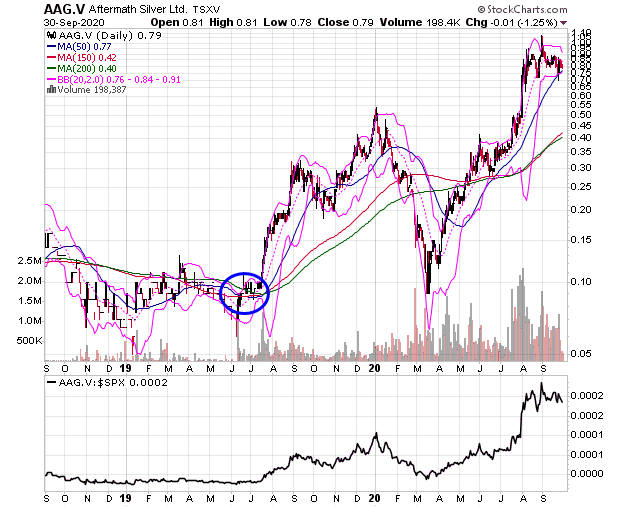

Sometimes the best way to find a new winner in the stock market is to find a stock that is new and very similar to your last big winner! My top stock pick for this month is Silver Dollar Resources Inc., which trades as SLV on the Canadian securities exchange and under the ticker SLVDF on the US OTC, because it has a lot of similarities to one of the best stocks that I have bought over the past year. That is Aftermath Silver. I bought it for less than 10 cents back in 2019 and made it my top stock pick of the month in August of that year. The stock went up like crazy as you can see from this chart.

When I first bought Aftermath Silver it was just starting out as essentially a new blank check company signing its first deals to acquire what became a string of silver exploration properties. It went up to over $1.00 a share a few weeks ago to go up more than 10X that ten cents price. I still own the stock and today it has a market cap of $68.90 million USD.

There are two big things that helped make company management turn it into a big winner. First is the price of silver and second is the players that got involved in it. These stocks serve as what my friend Jordan Roy-Byrne calls an “optionality” play on silver, because they own silver properties that go up in value when silver goes up.

The Recent Silver Pullback Makes Now A Time To Buy On A Dip

Silver went up like crazy over the past twelve months and has been actually outperforming the stock market so far year to date, because the price of silver went up more than the S&P 500 has done and even more than most of the popular big cap tech stocks everyone talks about on TV did too. Check out this chart.

There are three key indicators you need to focus on with this chart.

1)The silver/spx relative strength ratio on the bottom of the chart shows us that the price of silver has outperformed the S&P 500 since January, because it been going up in a nice uptrending channel. If you want to beat the market the best way to do it is to buy the things beating the market.

2)Silver can be volatile and anything going up like silver does will at times have a pullback to retrace its gains. That’s a simple pause in a bull trend. We have seen the S&P 500 in fact come off 10% from its highs in September and silver has retraced roughly 1/3 of its gains. That’s what the retracement indicator overlaying the chart is showing. If silver were to retrace 50% of its gains that would bring it down to roughly $20.74. I don’t think that is going to happen, but that shows that the downside risk is fairly minimal.

3)The daily stochastics indicator for silver is oversold and just gave a buy signal by falling below 20 and then crossing back above it. Silver is likely to trade sideways around this current price for the next few weeks now making a good time to invest in it and an even better time to buy the top silver mining stocks, because when silver goes up they go up even more as Aftermath Silver demonstrated.

When You See A New Stock With Industry Leaders Pay Attention

When Aftermath Silver got going several big leaders in the mining sector made big investments in it. Palisade’s Goldcrop took a 10% stake in the company and mining legend and billionaire Eric Sprott invested in multiple private placements in it too to the point where he now owns over 19% of the company.

Silver Dollar Resources Inc. (OTCMKTS: SLVDF) is a new company for 2020 that just started to trade on the US OTCQB yesterday. It has a market cap of less than $40 million US dollars (that’s less than 58% of Aftermath Silver’s market cap) and just closed a private placement in which Eric Sprott and First Majestic Silver (NYSE: AG) acted as lead investors. Eric Sprott now owns 19.9% of the shares of Silver Dollar Resources and First Majestic Silver owns 16.4% of the shares. You cannot have two more important players involved in a new company like this than these two and they recently bought shares at $1.40 a share with a $10.5 million CAD private placement.

Here is a chart of the stock.

As you can see much like the price of silver itself this stock has been consolidating in a range that is likely to come to an end soon. I own the stock and think it is a good buy now, because the current price is not that far above the price that Eric Sprott and First Majestic bought at.

Also when you consider the money that they invested the company is flush with cash and has a very cheap market capitalization. The company owns projects located in two of the most prolific mining jurisdictions in the world that include the advanced exploration/development stage La Joya Silver Project in Durango, Mexico, and the discovery-stage Pakwash Lake and the Longlegged Lake properties in the Red Lake Mining District of Ontario, Canada. It is fully funded to begin operations to drill and explore these properties. I will have more updates on them and the company coming soon will likely be talking about it for the rest of the year. For now you can take a look at their full corporate presentation by clicking here.

-Mike

Disclosure: Mike Swanson owns shares of Aftermath Silver and Silver Dollar Resources, Inc. Because they are small cap stocks with a market cap of less than $100 million he has put himself on a trading blackout on both stocks and will not buy or sell a share of them for at least 30-days from the date of this post. Wallstreetwindow.com, is owned by Timingwallstreet, Inc., which is being compensated by a third party (Leadgopher LLC DBA Pinnacle Ad Network) to conduct an investor awareness advertising and marketing campaign for Silver Dollar Resources, Inc. This third party paid Timingwallstreet Inc., $23,000 to produce and disseminate this and other similar articles and send traffic to them through paid advertising online campaigns for 30 days beginning October 1, 2020. This compensation should be viewed as a major conflict with our ability to be unbiased, more specifically: This communication is for entertainment purposes only. Never invest purely based on our communication. For more on trading risks read our policy statement by clicking here.