HERE IS WHY THE STOCK MARKET STARTED TO DROP (AND WILL END)

The stock market is pulling back, but is not going to dive like it did in March.

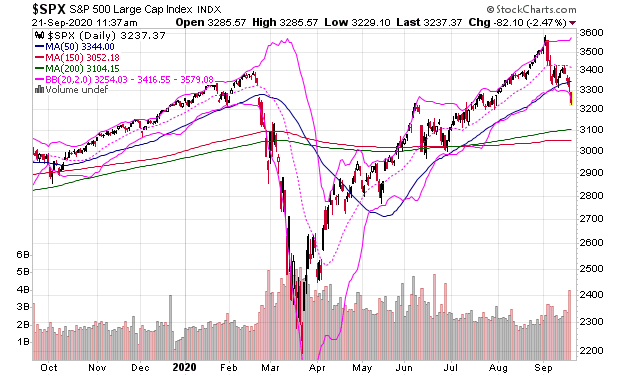

Since last week the stock market has gotten hit hard with selling led by big cap technology stocks. Last week the S&P 500 closed below its 50-day moving average and there is heavy selling happening today as follow through. Take a look at the chart.

The media must come up with explanations for every gyration in the market and an article on CNBC declared last Thursday when the drop began in a headline that “The market isn’t convinced the Federal Reserve can achieve its inflation objective.” I don’t believe that is why the stock market has dropped at all. People are coming up with all sorts of reasons to explain the market decline and even using them to place blame on some people, but the simplest explanation is easy to see if you look at the long-term trend on the charts.

For instance look at the Nasdaq 100.

From its March low to Labor Day the Nasdaq 100 and the entire stock market had a tremendous rally – it was one of the largest rallies in such a short amount of time ever in the history of the stock market. In fact the 90 day rate of change indicator for the Nasdaq 100 even hit a record level.

The momentum of the market rally going into Labor Day simply became unsustainable as it almost doubled in price in less than six months. For it to go on like it was the stock market would have to almost double again by March.

In 2009 when the stock market bottomed the Nasdaq 100 doubled in about a year. It then took it over four years to double again. It takes time for a market to make gains like that – and this market was not going to do it again in six more months.

And so it stalled out.

That’s why the Nasdaq has fallen roughly 10% off of its highs.

No one wants to tell you that, because they are afraid you’ll get mad at them, but this is what happened.

So it’s time to be cautious. It doesn’t mean the market is going to crash, but it does mean some of these gains from March are likely to be retraced. Just take a break if you are a big cap tech trader.

And something is always going up. For instance gold and silver fell less than the stock market did in March when the market crashed and have been beating the market in terms of performance year to date all year. Silver and gold are less volatile than the S&P 500 is and are in a position to go up for years thanks to their charts and these Federal Reserve policies. That’s what I’m focused on.

If you are new to my work then you need to join my free email update list as we follow this unfolding situation for the next big buy point. Then you'll also get my top stock pick of the month. Just click here to subscribe.

-Mike

You have come to WallStreetWindow, the website founded by former hedge fund manager Michael Swanson. Join his free email update list and every morning you'll get his market insights and trading ideas before the opening bell and even the top posts he sees of note that day from his friends. To begin put your email into the form on the right now and it's all free.