Here is how to find the best junior mining stocks and small cap miners. In this presentation I go over this area of the financial markets and how to take advantage of it.

The best gold stocks are going up faster than the rest in this new gold bull market.

To get my next stock pick for free just get my free monthly PDF newsletter by getting on my email list. Scroll below or go to the right sidebar to start.

Here is a transcript of the above video:

Hey, this is Mike Swanson. Today, we’ve gotta talk about how to get into the best junior mining stocks. If you’ve been paying attention at all to what’s been going on with the financial markets, you should know that gold stocks have been going up like crazy this year. So far year to-date they’re in fact the top gaining sector in the entire stock market.

Look at this gold price chart and the big cap mining stocks ETF.

This is the GDX ETF. It’s gone from $113 a share in January to up to $31 a couple of weeks ago and I think, the move has only just started. And it’s gonna go up for the years to come. That’s because we’re in a new bull market.

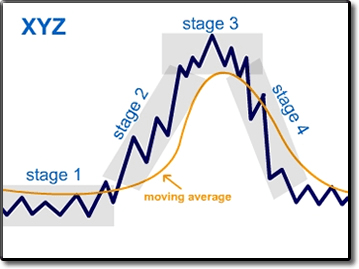

We’re in a stage two, cyclical bull market, where the market is above its 150-day moving averages for gold stocks and the GDX. And most of these things go on for three to five years. So, it’s just begun, and big cap stocks are going crazy.

This is Newmont Mining, it went from $16 to $40 but what you may not know is that the small cap mining stocks are going up even more than that. Some of them, are going absolutely crazy, because the move in that’s just starting.

This is the CDNX. It’s the Canadian Venture Exchange, it’s an index for that. You can see what it’s done, straight up and it’s only starting. This is like where the stock market was in 2009. And you know what the stocks market’s done.

So this is GLDX. It’s an ETF that owns a basket of small cap gold mining stocks. These aren’t Newmonts, these aren’t Barricks, these are very, very tiny stocks. But the reason why you might wanna get into these things is that the gains in the small cap stocks, can be much bigger than the gains in a big cap mining stock.

THE OPPORTUNITY IN JUNIOR MINING STOCKS

What happens typically at the start of a bull market for mining stocks and mining companies, is that the large caps act stronger at first. They go up first. But then as the gold bull market goes on, more and more of the small caps start to come alive, and then go up at a faster rate than the big caps have gone up at. And we’re now reaching that inflection point.

Yes, you can still make lots of money in big caps stocks in GDX but you can make even more money in targeted buys in the right small caps. This is just one example of what’s going on.

This is Galane Gold, it went from five cents to 19 cents in a space of three days, just a couple of weeks ago. And that’s what happens when the small caps come alive. You get massive moves in a short amount of time. You have stocks that can be a nickel or 10 cents go to $1, or $2, or even $3 in the course of a couple of years. And that’s why there is so much potential here.

THE TWO TYPES OF JUNIOR MINING COMPANIES

There are two types of small cap mining companies that you need to know about. You’ve got junior mining companies. These are companies that have bought dormant mine and they’re bring it back up into production. These mines might produce 25,000 ounces of gold. Sometimes, they produce up to 100,000 ounces of gold.

But these companies own these properties, they look to put the mines back online. And that creates an incredible growth story opportunity for people who buy these types of situations early in the game. And a lot of times, these types of companies get bought out by the big cap mining stocks. Because what happens is, companies such as Newmont and Barrick, they need to be constantly looking to increase their gold production, looking to produce new mining operations.

And they look for these small cap situations to buy into in order to do that, in order to maintain their earnings per share. ‘Cause what happens is, mines have a limited life cycle and these things run out. They can last for 10 years, sometimes five years, sometimes longer than 10 years. But they have a limited life cycle. So, Newmont has to always be looking for new opportunities to buy companies out, because they can’t do everything.

And that’s where exploration stocks come into play too.

Exploration stocks don’t produce gold. Most of them don’t even have any earnings to speak of. But what they do is they buy properties and the rights to mine properties, in places around the world. And they drill these properties to find out if there’s a good enough deposit of minerals to put a mine into operation there. They may not have the money to actually do the mining themselves, but they’re gonna look to discover that this… Yeah, this property can be mined. Then they’ll either go and raise more money to put the mine into production or they’ll show what they got and a big company will buy them out – someone like Newmont and Barrick again.

And Newmont and Barrick and other big caps do these kind of exploration activities themselves, but they can’t do this with properties all over the world. Or they’ll partner up with small cap mining companies or small cap exploration companies, juniors to do these kinds of stuff. And this is what these kinds of stocks are.

So Galane Gold, for example, that’s a small junior mining company. It doesn’t have the mining operation yet, but it’s looking to put one in to operation. And when they announce that, it’s got the go ahead, that’s when the stocks surge. But here’s the deal, these small caps typically have market caps less than $100,000,000. The typical pure exploration play usually gets to a market cap at the $25 to $30 million dollar range, even if they don’t have a great deposit.

So, right now, after this giant bear market of the past couple years, there’s many small cap mining companies in market caps of $10 million, $5 million, or below.

And that’s where we’re at a sweet spot of opportunity right here.

Evaluations are depressed, share prices are depressed, where we have many stocks trading at five cents, 10 cents, that are going to go up to 25 cents, 30 cents, I believe, within the next 12 months. And those are the bad ones.

The upper tier of these type of companies are gonna go up much more beyond that, and that’s what I’m looking to buy. I’m not looking to just get into something that I think is gonna go up because evaluations are depressed, but something is going to go up for that fact. And also because it’s a superior play, and those are ones that can go up even at a great multiple. And those are the best of the best.

Which Small Cap Mining Stocks Are the Best?

Which are the best to buy?

You look at three key factors.

One, you look at the location.

Where is the property at that the junior mining company owns, or is looking to explore?

Is this a property that’s located around other great finds over the decades and years, that have been discovered to be great places to mine, too?

Because what happens is, once you have a hot property, usually the areas around that are going to be home to greater, more discoveries.

So, location is key.

You also want to be in localities, countries where it’s easy to do business in.

You also need a management team that’s got a past record of success in doing great deals, having great success, and so forth.

That’s kind of common sense, but you look for that.

And then you also look at what’s the share structure of the stock you’re looking to buy into?

How many shares are outstanding, how many financings have been done before, and so forth to see what’s the potential for the float to rise up and go up even more, and become a big and powerful stock to own.

So, these are the things I look into.

These are things you need to look into, because the opportunities in these stocks, in the right ones, in the best of the best, are great. Now is the time to pay attention to all of the breaking junior mining stocks news.

So, subscribe to my free email list by scrolling below.