According to Michael Barr, the vice chair for supervision at the Federal Reserve, Silicon Valley Bank’s failure was a “textbook case of mismanagement.” Perhaps that’s unsurprising. Regulators are unlikely to conclude that the second-largest bank failure in American history was due to inefficient regulation. What did SVB management do? Why did they do it? And, was the problem purely inadequate management?

To understand SVB’s fall, we must look at its assets and liabilities. A typical commercial bank’s liabilities include a large number of small, insured deposits. This strategy is basic risk diversification. By dealing with many small deposits, a few withdrawals will not affect the bank’s financial situation. The risk of a bank run is minimized.

SVB, in contrast, served a small number of large, uninsured accounts. Additionally, many of these accounts came from the same risky industry: new, venture-capital-funded, IT firms. SVB concentrated its risk on larger deposits from one sector with risky startups.

On the asset side, SVB held a large number of US Treasury bonds. A bank uses market values (mark-to-market) to account for the bonds it plans to sell before maturity. Alternatively, it can mark the bonds at face value if it intends to hold them until maturity.

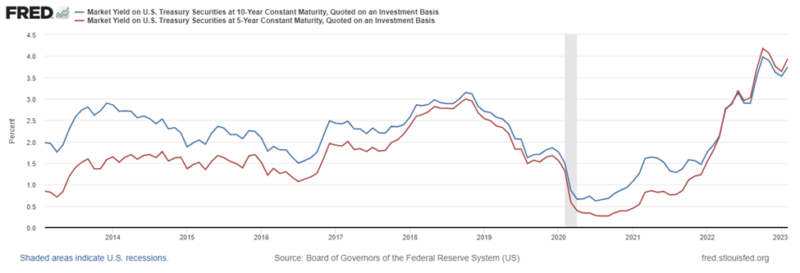

Interest-rate movements affect the mark-to-market valuation, but not the face value of the bonds held until maturity. The Fed’s rapid increase in interest rates pushed the market yield on US Treasuries to its highest levels in the last decade. With high exposure to a struggling sector, SVB had to sell more US treasuries than it had anticipated. Some of the bonds initially intended to be held to maturity had to be marked-to-market, exposing substantial financial losses. Seeing these losses, uninsured depositors rush to move their funds out of SVB. The rest, as they say, is history.

It is not apparent, however, that SVB’s failure was purely a case of mismanagement. Regulators cannot forget that banks (like any other firm) react to regulatory incentives and expectations. The market has come to expect large financial institutions will be bailed out if necessary, with the recent joint statement by the Fed, Treasury, and FDIC affirming that view. Financial institutions believe profits will be private, while the costs of failure will be socialized. This environment is not the outcome of a free market. It was a policy choice.

Now, there are calls to expand deposit insurance—with some arguing that all deposits should be covered. That would be a step in the wrong direction. “[D]espite the common perception among both laymen and economists that deposit insurance helps stabilize the banking system,” Thomas Hogan and Kristine Johnson write, “most empirical studies find deposit insurance decreases stability.” Expanding deposit insurance would make this worse, with banks responding by taking on even more risk.

SVB’s management strategy is no excuse for supporting or expanding inefficient regulation. The mismanagement was endogenous to the regulatory regime. Rather than promoting financial stability, regulators have undermined it. Doubling down on a failed strategy will not make things better.

THIS ARTICLE ORIGINALLY POSTED HERE.