I haven’t done an update on the markets for over a week. I was traveling a bit two weeks ago and I really had no real new opinion on anything. There just wasn’t anything important happening in the markets, and I think that is going to be the situation for this week too. Earnings season is going to pick up, but the market is likely to ignore bad earnings news for now, much like it did last week. Bulls still have an eventual “Fed pivot” to buy into. The Wall Street Journal had an article this Sunday that showed that individual investors on average lost over 29% in their accounts last year, but have engaged in near record buying in the first quarter of this year. They are chasing the rally and doing most of their buying in ETF’s like SPY and QQQ.

At some point the market rally is going to end, but that could be in a few weeks or in a few months. It is hard to make some prediction on that right now. Sometimes not much is happening and now is one of those times. Mass buying from small investors last year helped make the bear decline a slow motion one, instead of a violent drop, and is helping the market indices seemingly ignore the bank stock crash this March. Their number one stock to buy remains TSLA. Cathie Wood remains the guru of today’s markets and not someone like Peter Lynch or Warren Buffett, as they were in the past. Social media posts and Tweets are the mechanisms through which the masses understand their reality. Shaping that with algorithms is how today’s tech overlords try to rule and how Elon Musk has created himself into an object of adoration for so many.

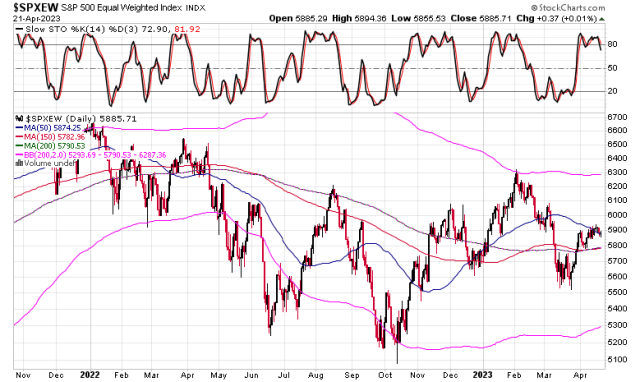

Here are some charts.

The S&P 500 closed last week almost exactly where it started the month at and closed the month of January. It’s above where it was in December, but below where it was last August. Banks stocks broke down and crashed in March, but the S&P 500 has been helped by the fact that it is a market cap weighted index. So, buying in MSFT and AAPL has helped to push it up.

When you look at an equal weighted index of the S&P you can see that the recent market rally is worse than what it appears from just looking at the Nasdaq and S&P 500.

I see no real great bets to make in the market now – the time to buy stocks was back in the October – January time frame now – NOT NOW.

I’m personally invested at the moment 60% in short-term bonds and CD’s and the rest in gold, silver, and mining stocks.

I have not made a trade in over a month.

Fed fund futures are now pricing in a rate hike at the next May FOMC meeting.

They are also saying that will be the last rate hike.

At the same time, the St. Louis Inflation Now indicator suggests that inflation is not improving at all in this month.

Cathie Wood says TSLA is going to 2000 and this is the type of talk that the algorithms promote to people. She says that and Youtube videos get pushed talking about it and news stories proliferate for 24 hours on Google news and all the other news apps, putting that up as the top headline of the day this past Friday. TSLA closed Friday at $165 a share with a market cap of $517 billion. So, we are expected to believe that it can grow to become a company valued at over $6 trillion – all rational talk is drowned out and people have been programmed by the feeds to believe that this type of talk is sensible.

Meanwhile, while the masses ignore it, gold is still outperforming the S&P 500.

It is gold and silver that will benefit continue to the most in the years to come from the end of the current interest rate hiking cycle and that is why they have been doing sell since the last cyclical top in the stock market back in January of 2022. One of the most important moments of the past few years was when interest rates went to zero in 2020 to hit a secular low that will never be seen again for the rest of our lives. Everything that has happened since in the markets has been a result of this fact.

To get my stock trading updates subscribe to my free email newsletter, just click here.

-Mike