Last week’s article (“De-dollarization Has Begun”) produced a large number of comments and follow-up questions. Enough, in fact, that it feels necessary to address the most common of them in a follow-up piece. Some of these responses require a degree of speculation, while others are quite straightforward.

- Is the reduction in use (or complete abandonment) of the dollar as the global reserve currency something I should be worried about?

Almost certainly not. A few points need to be made here. First, barring a truly extraordinary event or series of developments, a scenario in which the dollar is no longer used (at all) in international trade is highly unlikely. The prospect of such a thing happening in a short period of time – days, weeks, months, or even a few years – is virtually impossible.

The size and breadth of the US economy and our vast trading relationships virtually assure that to some extent or another, the dollar will remain, at the very least, among the top currencies used to denominate and/or settle global transactions. The power of path dependence in this context is demonstrated by the fact that the first-mover advantage imparted by the Bretton Woods agreement, which ended in 1971, remains in effect. There are high barriers to exit and switching costs, and presently much of the international commercial community, be it individuals, firms, or governments, “think” and calculate economically in dollars. If the dollar were to be cast off in favor of some other currency, the transformation would take decades, and possibly generations, to complete. There are far more pressing issues, economic and otherwise, for Americans to worry about.

- What are the odds that the Chinese yuan will transplant the dollar as the currency of choice in world trade?

At present, even beyond the decades that such a change would probably take, the likelihood of the yuan becoming the global reserve currency ranges between profoundly unlikely to essentially impossible. The yuan is pegged to the US dollar, and thus does not float. In other words, its exchange value is not subject to market forces. That peg permits Chinese monetary authorities to adjust the currency value to benefit Chinese exports. Additionally, the Chinese capital account is closed, which essentially means that capital does not flow out without approval. These (and a handful of other characteristics) are simply not conducive to establishing a currency that will be used as a unit of account, medium of exchange, and/or basis for settlement in countless international transactions daily.

- What are the most viable candidates among currencies to replace the dollar or take “market share” from it, if any?

Let’s return to two core assertions: first, that a more probable scenario is for the dollar to be joined by other currencies in a multi-reserve currency regime than to be replaced outright, and second, that the currencies of China (and others) that are pegged are improbable replacements for USD. It bears remembering that there are transactions of considerable volumes and sizes which take place in other currencies other than the dollar every day.

An estimated 95 percent of world dollar payments are settled via SWIFT (the Society for Worldwide Interbank Financial Telecommunications). That’s an estimated 11,000 member institutions, in 200 nations and territories, transacting via some 42 million messages per day. The average daily amounts are estimated, in dollars, at about $5 trillion, or $1.25 quadrillion dollars per year.

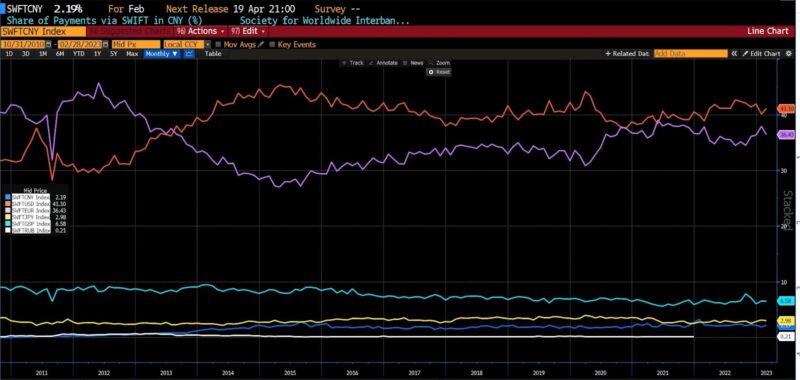

Below is the average percentage of payments made daily in any number of currencies in the SWIFT system during February 2023. The US dollar and the euro clearly dominate global payments. And even 70+ years after ceding the top spot to the dollar, the pound sterling averages two to three times what the yuan, ruble, or even yen account for. (The white line representing ruble ends in early 2022, which coincides with the SWIFT ban.)

SWIFT payment shares in percent (Sept 2011 – Feb 2023)

The euro would need to take at least ten percent of the dollar’s current “market share” to equal the transaction volume of US dollars in the primary global financial payment system. That’s a tall order, representing as it does a shift of hundreds of billions of dollars per day from USD to EUR. One could also imagine the Canadian dollar, the Korean won, or the Swedish krona – all of which are unpegged and produced by economies with open capital accounts – increasing in their share of global transactions, but nevertheless remaining far too small to reach the proportions of the dollar or euro.

- If the dollar were to lose its reserve currency status completely, or the share of the dollar’s use in international transactions were to plummet, wouldn’t we experience hyperinflation/deflationary collapse/a recession/a depression?

Neither the dollar nor America as a nation would disappear if the dollar were to somehow lose its perch, barring exceptional or unforeseen circumstances. The English pound is no longer the world’s reserve currency, and yet England and the pound are very much alive.

There’s no reason to believe that an economic disaster would necessarily result from less use of the dollar in global transactions, although the situation surrounding that decline factors into the outcome. Over time, less global demand for the dollar would result in a gradual depreciation of its value to some degree or another. That depreciation, depending upon whether mild or severe, would have certain effects. A mild depreciation would tend to make US exports more attractive to foreign consumers while imports would become more costly. A rapid depreciation would (among other problems) result in severe difficulties for producers and consumers – in particular where the production of sophisticated goods and services requires numerous inputs from around the world. There is also the possibility that the global demand for US government securities would decline as well, as was discussed in the previous article. Those effects could significantly impact both US fiscal and monetary policy over time.

- If the yuan, ruble, and other currencies are no match for the dollar, why are some other countries beginning to transact in them?

It’s a question of tradeoffs. Transacting in less-liquid currencies is bound to be a bit more inefficient, more costly, and involve more underdeveloped (thus possibly error-prone) practices and technology than in established dollar or euro systems. But given the increasing use of the dollar as a means of imposing sanctions, some foreign powers see a pressing need to develop the capability to transact outside of US-dollar-based systems. We are witnessing the development of financial contingency plans.

The possibility also exists that recent Federal Reserve missteps, in particular those which led to the highest inflation in 40 years, are feeding an instinct to develop hedges against US monetary policy.

National pride is undoubtedly a factor as well. It’s probably difficult for autocratic regimes to convince their populations that everything is under control when most business is conducted in US dollars. (Imagine the dissonance arising of a state trying to convince its citizenry that it is protecting them from Yankee imperialists…even as most of the population eagerly seeks to acquire currency with pictures of Washington, Lincoln, or Hamilton on it.)

- It sounds as if there really isn’t much to worry about. What’s the point of discussing this now?

New reserve currency ideas and proposals go back a long way. But recent developments suggest a distinct ratcheting-up of projects explicitly pursuing non-dollar trading relationships. The knock-on effects of changes of this sort, even developing gradually, may be more far-reaching than anyone may envision. This is especially the case considering that unleashing the full potential of comparative advantage requires trade. Taking note of these developments, even as they slowly unfold, is in the best interest of all Americans.

THIS ARTICLE ORIGINALLY POSTED HERE.