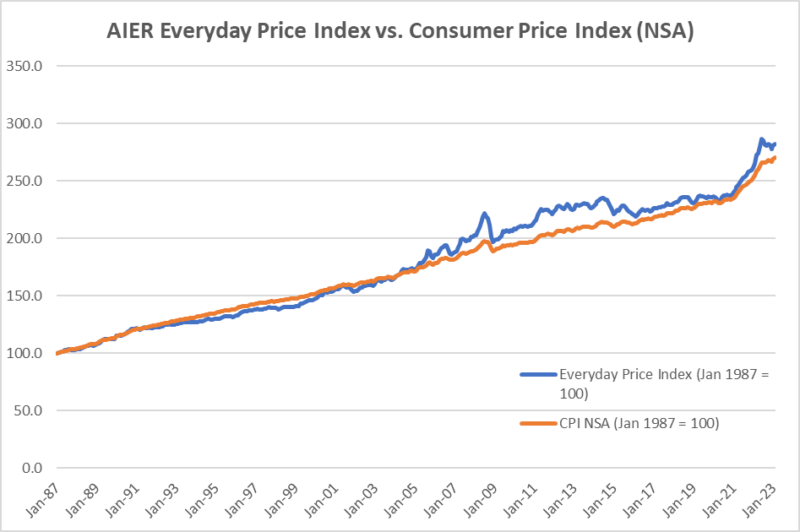

Following a 0.93 percent rise in January 2023, the Everyday Price Index (EPI) rose 0.67 percent in February 2023. At 282.6 (1987 = 100), AIER’s EPI is at its highest level since July 2022 (285.4). Among the EPI constituents, the largest month-to-month increases were seen in cable, satellite TV and radio services, prescription drugs, and tobacco and smoking products. The largest declines came in fees for recreational lessons and instructions, domestic services, and household fuels and utilities.

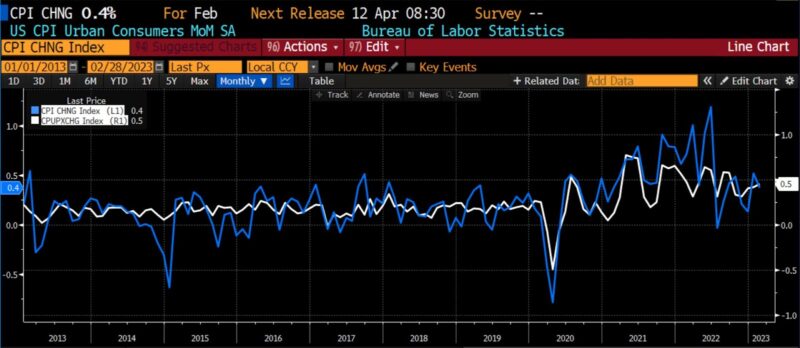

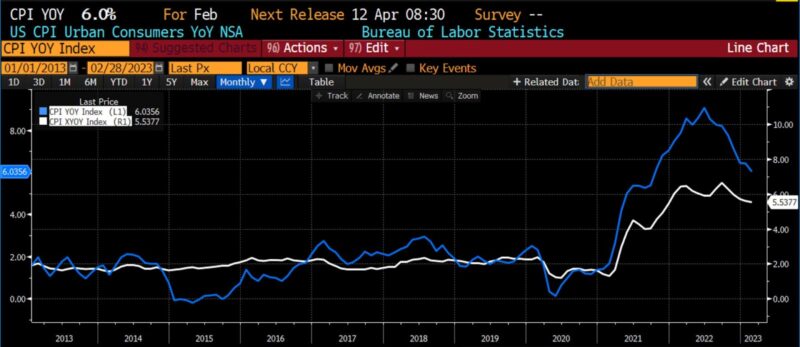

The US Consumer Price Index (CPI), released by the Bureau of Labor Statistics at 8:30am EDT this morning, reported a month-over-month headline increase of 0.4 percent, which met expectations. Core CPI (month-over-month) came in one tenth of a percent higher than expectations at 0.5 percent. Both year-over-year headline CPI and year-over-year core CPI met expectations of 6.0 percent and 5.5 percent, respectively. AIER’s EPI is up 6.6 percent over that same time period (February 2022 through February 2023).

February 2023 US CPI headline & core, month-over-month (2013 – present)

Among the components contributing to the rise in the core CPI index, the most prominent were shelter, recreation, household furnishings, and airfare. Providing some relief in February was the smallest decline in groceries since May 2021. Egg prices, which have become emblematic of price spikes, saw a decline of 6.7% in February 2023. Used-car prices declined 13.6 percent on a year-over-year basis, the largest decline in that CPI component since 1960.

Costs associated with shelter rose 0.8 percent in February, adding to an 0.7 percent rise in January. Rent and owner’s equivalent rent increased by over 8 percent year-over-year, a record increase. Shelter numbers can be misleading, though, as they are reported with a lag. Recent data suggest that within the shelter category, costs are beginning to decline.

February 2023 US CPI headline & core, year-over-year (2013 – present)

As was the case in January 2023, AIER’s EPI shows a larger month-over-month increase in household costs than either the headline or core CPI readings indicate.

The path of Fed policy is undoubtedly cloudier than it was even a few days ago owing to financial stability concerns. As recently as last week, a 50 basis point hike to the Fed Funds rate target was viewed as a distinct possibility at the 21-22 March FOMC meeting. The weekend collapse of both Silicon Valley Bank and Signature Bank of New York, however, have vastly increased the likelihood of a 25 basis point hike or a pause in the Fed’s ongoing contractionary policy measures. Two weeks ago, on March 1st 2023, market implied policy rates (MIPR) saw terminal rates at 5.52 percent within six months. After this morning’s CPI release and in light of concerns over the health of the US banking system, that estimate had dropped to 4.81 percent, suggesting expectations for a single quarter point rate hike between now and September 2023. The path to restoring the 2 percent annual inflation target has likely become longer in light of recent events.

THIS ARTICLE ORIGINALLY POSTED HERE.