On Tuesday, the first trading day of the year, the stock market had a big gap up on the open and then faded to close in the red. Usually the market has a positive week to start the year and ends up having a bullish January. New money flows into the market for retirement accounts typically happen, and people selling losers before the year is over for tax loss selling, is probably why, but I have seen years where that did not happen and they typically were bear market years. Those weird years usually saw a big gap up opening to start the year that was a trap.

And we are in a bear market and that is the big picture that I wrote about Monday.

That said, I did not feel confident about what the market could do this week and don’t trust the action one way or the other this month.

If we get a panic sell-off with a VIX spike later this year I’ll probably do some buying and if the market were to rally into the February Fed meet I’d probably do some short selling. That’s my thinking right now, so what happens this week doesn’t matter to me. I already have a bunch of long positions and am not planning on doing much anytime soon.

I also have more trust in gold going up this year, as it is above its 200-day moving average and we are approaching the end of this Fed hiking cycle.

But here is the chart of the S&P 500.

The S&P 500 is floating around the 3800 level.

Is this a pause before another rally attempt to the bear market downtrend resistance line or a pause before another dump?

Flip a coin.

But, some big cap popular stocks are just dumping.

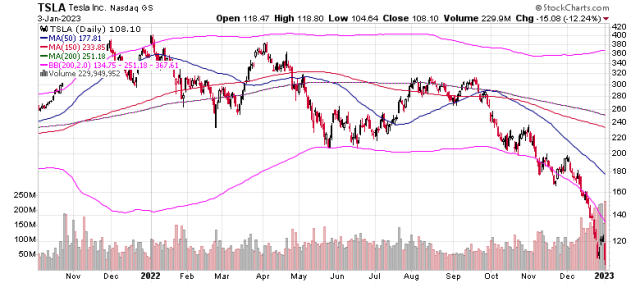

Look at TSLA, down over 12%.

That’s another 52-week low for TSLA.

And AAPL made one too, yesterday.

Both of these stocks were huge laggards against the S&P 500 last year and there is no reason to think that will not be the case again in 2023.

Laggards lag.

No matter if the market goes up this month or not, the prudent thing to do is get out of laggard stocks and into leading sectors.

Gold and silver are beating the market now.

So, while I’m not giving you a prediction for the S&P 500 this month, I can tell you I think gold will beat the performance of TSLA and AAPL shares in 2023 just like it did in 2022.

Again, focus on the big picture, as understanding how bear markets work is going to be a key to navigating the financial markets this year.

To get my free stock market updates join my free email list by clicking here.

-Mike