DOW had a big relief rally yesterday after the FOMC announcement, but is this just a one day wonder rally or the start of a big rally like so many are predicting now. Load up your Twitter and you’ll see what I mean if you follow stock market people. If a lot of yesterday’s gains are given up today and tomorrow I’d think it’s just going to chop around and make another leg down this month. This feels to me more like the February bounce than the March rally that came after that previous Fed meeting.

It’s tough to try to trade things below their 200-day moving averages, but commodities are still in a bull market and there is no sign that they are topping out. If anything, they look like they are getting ready to go up again.

Take a look at this broad commodity ETF, which tracks the CRB index.

Oil typically rallies into July and then has a seasonal peak.

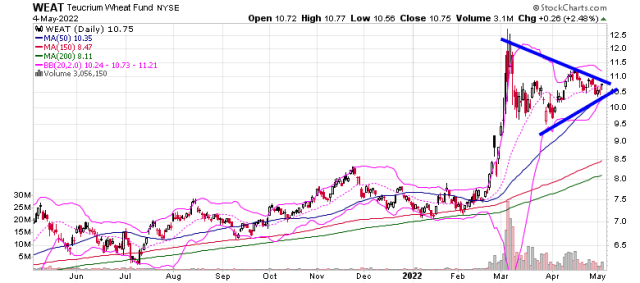

And the price of wheat also looks like it will go up again.

At the moment gold is trading better than silver.

-Mike