The best stocks to invest in or simply trade are the ones that outperform their sector group and outperform the entire stock market. This is the story for York Harbour Metals, which trades as YORKF on the US OTC and as YORK on the TSXV. Last year it was trading as PXA and the company name was Phoenix Gold.

The name change reflects the huge success the company is having, but the success isn’t a huge surprise as one of the biggest shareholders and investors in the company is Eric Sprott, who has a 5% ownership stake in it. Sprott is a mining industry legend with a midas touch who has recently been linked to Hycroft Mining, which became one of the top gaining stocks on the US stock exchanges last month, so it may not be that long before Hycroft traders figure out what else Sprott owns. I actually had York Harbour Metals as my stock pick of the month when it was Phoenix Gold last year back in November and the reasoning behind my article about it back then provides some valuable lessons.

First take a look at the stock chart.

Stockcharts is using the old symbol still in their charts. What I pointed out in November was that the stock was outperforming the GDX gold stock ETF. It’s PXA/GDX relative strength ratio was firm from August through October last year while there was a dip in the metals markets and mining stocks in general. This stock, though, did not dip to show that it was displaying powerful sector leadership and getting into a position to lead on the next sector rally.

When November came it began to do just that and continued to do so through last year and is continuing to do so now. In fact, the relative strength ratio made a new high just the other week. If you want to get into a leading metals exploration stock this is one to buy.

There is a big reason why all of this is happening. The company changed its name to York Harbour Metals to reflect exactly what is drawing investor interest in it and into its stock.

What the company owns are exploration and mining rights to the past-producing York Harbour Copper-Zinc-Silver Project located approximately 27 km from Corner Brook, Newfoundland and Labrador. Currently, the Company is completing its Phase 3 drilling program following up on the impressive drill intersections previously reported.

Since my article in November the company, has demonstrated positive drill results and even filed a 43-101 technical report with SEDAR and expanded its land package for York Harbour!

Just two weeks ago, the company announced off the chart drill results to “report high-grade copper and cobalt values in diamond drill hole YH21-24, grading 5.25% copper, 436.5 g/t cobalt, 8.97 g/t silver, and 0.801% zinc over a drilling length of 29.0 metres at the Company’s York Harbour Copper-Zinc Project (the “Project”) in Newfoundland. Drill hole YH21-22 intersected strong zinc and copper values over a 5.26-metre interval, grading 2.84% copper, 31.96% zinc and 42.09 g/t silver.”

Bruce Durham, Chairman, commented, “High dollar value, high grade copper mineralization like the intersection in drill hole YH21-24 is very rare and they are important indicators of strong mineralizing fluid systems at work. We know there are numerous indications of copper and zinc mineralization in the local area and most remain only partially defined. By proceeding to drill these mineralized areas in detail we will begin to establish a solid understanding of the size, mineralogy, structural controls, and grade distribution within these various areas of known VMS style mineralization.”

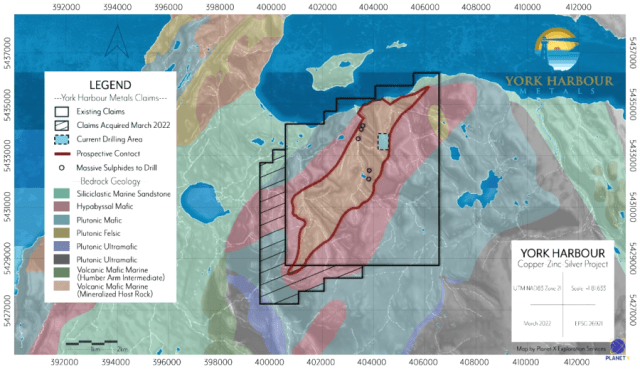

According to a company release, York Harbour Metals has also “increased its strategic land positioning at the York Harbour Copper-Zinc Project (the “Project”) in NW Newfoundland. An additional 825 hectares (8.25 km2) adjoining the western and southern limit of the existing mineral claims have been acquired via staking; the Project area now totals 4,725 hectares (47.25 km2).”

Highlights:

- The Company now controls the entire surface exposure of the volcanic mafic marine unit, the host rock of the known massive sulphide mineralization (as highlighted in Figure 1).

- Key Project land holdings have increased by 21.15%. The three drilling programs to date have focused in a very small part of the large land package.

“The additional mineral claims now encompass the entire southern folded nose of the stratigraphic contact between the Lower and Upper Basalt units within the Bay of Islands Ophiolite Complex. Recent exploration results indicate the massive and semi-massive, copper- and zinc-rich volcanogenic massive sulphide (“VMS”) mineralization with attendant silver, cobalt, and gold values, is spatially associated with this slightly overturned, northerly trending stratigraphic contact.”

“Immediate exploration plans for the Project include diamond drill testing of four obvious exploration targets: the No. 4 Brook Showing where massive pyrite-chalcopyrite mineralized float has been found to occur along a 50-metre long section of the creek cut; both the Pinnacle Showing and the K Zone are geological targets with coincident copper, zinc, lead, and silver soil geochemical anomalies; and the 500-metre section north of the A Zone with greater than 1% copper mineralization reported in the last 50 m of the Sea Level Adit.”

CEO & President Andrew Lee comments, “Since we started our Phase 1 drilling program at the York Harbour Project in July 2021, our exploration team has not skipped a beat. The presence of strong mineralization in the core within all three phases of drilling has given us the confidence to continue drilling as aggressively as possible. The results to date have reassured us of the blue-sky potential of the Project and we are committed to fully evaluating the many targets along this favourable geological contact, both near surface and at depth. Historically, the York Harbour Mine development and production focused on a limited area of easy access, high-grade copper-zinc-silver mineralization lenses near the surface; these lenses are now encompassed in our significantly expanded Project. With the newly extended land package, the Company is positioned to vector in on the most prospective targets across the full extent of the favourable contact. With the copper spot price trading at its all-time highs and zinc up 50% in a year we are even more committed to a strategic plan that will include near-term production.”

Suffice to say, all of this has the potential to provide even more positive news flow for shareholders.

You can access the company’s corporate presentation and get more details here.

I don’t have to tell you how much I am a believer in investing in the inflation trend. York Harbour Resources is in position to benefit from rising copper, zinc, and silver prices and its stock is now a sector leader in the junior mining and exploration space.

-Mike Swanson

Disclosure: Mike Swanson is the author of this article. Because York Harbour Resources is a small cap stock with a market cap of less than $100 million he has put himself in a trading blackout on the stock and will not buy or sell a share of it for at least 30-days from the date of this post (04/03/2022). Wallstreetwindow.com, is owned by Timingwallstreet, Inc., which is being compensated by a third party (Leadgopher LLC DBA Pinnacle Ad Network) to conduct an investor awareness advertising and marketing campaign for York Harbour Resources. This third party paid Timingwallstreet Inc., $8,000 to produce and disseminate this and other similar articles and send traffic to them through paid advertising campaigns for 30-days from the date of this post (04/03/2022). This compensation should be viewed as a major conflict with our ability to be unbiased, more specifically: This communication is for entertainment purposes only. Never invest purely based on our communication. For more on trading risks read our policy statement by clicking here.