The most fun type of stock to be in is one that is doing a stair stepping price trend pattern. I mean one stepping up and not down, like Bitcoin has been doing. And the thing is this type of pattern can play out in anything that trades – from ETF’s to individual stocks. Let me show you two examples of what I mean.

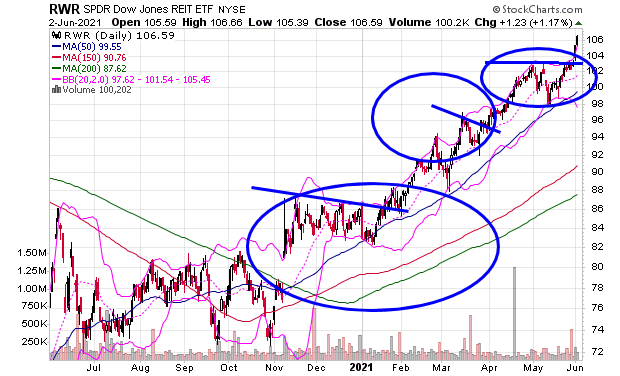

The first is RWR, this is an ETF that I own, and have talked about for several months that invests in real estate REIT stocks.

As you can see RWR paused three times on this chart and broke out to make another stair step leg up. It just started one a few days ago, and it went up yesterday on a day in which the Nasdaq and the ARKK ETF was down. This is what leading sectors do and it’s best to invest in leading sectors if you want to beat the market. They are the things that generate stair step up patterns.

Stair step drops are losing situations, as we have been seeing in things such as Bitcoin.

When Bitcoin dropped through $50,000 it fell through a trap door technical slaughter house. I warned that it was going to happen in early May. I made this warning, not because I can predict the future or am super smart, but because it was an obvious setup for anyone to see that can look at a chart and is able to be honest about what they see, including to themselves, meaning they are not part of the crypto “community” of HODL = LOSR people. Once you become part of that group it becomes harder to see what is really happening the deeper you become a part of it.

If crypto was something that was a good investment I’d be all for it, but it isn’t.

Now it looks like 30k on Bitcoin is the new 50k.

RWR and real estate stocks are 10000000% better as an investment than any crypto coin collectible is, because REIT’s are stocks that represent ownership in a company that generate revenues and pays its shareholders dividends instead of pure hot air.

What the crypto cult leaders have fooled some people into thinking is that the collectible coins are the only way you can make a quick return.

But this isn’t true.

Look at this stock, which is an old-fashioned REIT that I own that pays a 5% dividend.

Boom!

This stock is stair stepping up.

And this bullish pattern is playing out in my top small cap for April, Pacific Ridge Exploration.

In April, PEX jumped hard at the start of the month and then paused for a nice consolidation.

It then stair stepped up!

It has already more than doubled from the first trading day of April.

I still own it, because it’s fun to own it and it looks like it could move up again.

It is my hope that my top stock pick for this month, Full Metal Minerals, will do something similar.

It had a nice move on Tuesday.

It too can pause and stair step up again!

It’ll be fun to see if it can do it or not.

You can read the details about the stock and why I like it here.

-Mike

Disclosure: Mike Swanson owns shares of Pacific Ridge Exploration and Full Metal Minerals. Because both are small cap stocks with a market cap of less than $100 million USD he has put himself in a trading blackout on each stock and will not buy or sell a share of either of them for at least 30-days from the date of this post (06/03/2021). Wallstreetwindow.com, is owned by Timingwallstreet, Inc., which is being compensated by a third party (Leadgopher LLC DBA Pinnacle Ad Network) to conduct an investor awareness advertising and marketing campaign for Full Metal Minerals. This third party paid Timingwallstreet Inc., $20,000 USD to produce and disseminate this and other similar articles and send traffic to them through paid advertising campaigns for 30-days from the date of this earlier post (6/01/2021). He also engaged in a similar campaign for Pacific Ridge Exploration in April. This compensation should be viewed as a major conflict with our ability to be unbiased, more specifically: This communication is for entertainment purposes only. Never invest purely based on our communication. For more on trading risks read our policy statement by clicking here.