Gold began to turn up last week and closed yesterday near it’s critical $1750 resistance level, while the GDX closed right below $35.00. Both gold and the GDX mining stock ETF need to close above these levels before technical traders, much less the masses, get on board this rally. However, several mining stocks broke out of their March highs ahead of the metals and that’s a positive sign that it will happen.

Take a look at the price of gold and you can see how it now has been trading in a narrow range for almost a month.

Notice how the 20-day Bollinger Bands for gold have been coming together now and are close enough that their width indicator is now below 3. This means that price volatility for gold is shrinking. That’s why the masses are no longer watching it, completely asleep on it, but periods of shrinking volatility tend to lead to a volatility expansion. In other words gold is setting up for a big move.

Why?

Well, a close above $1750 will bring buyers in and create a willingness to chase the prices higher. That’s what makes for a nice rally. And some mining stocks are already doing it. These are the ones that are in a position to be mining stock leaders for the rest of the year.

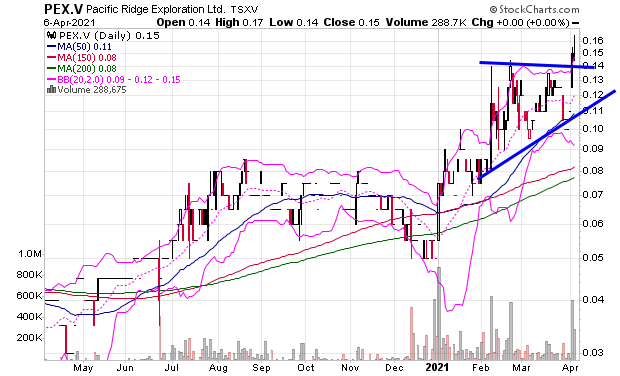

It’s starting to happen now with my top stock pick of the month Pacific Ridge Exploration (OTCMKTS: PEXZF).

PEX broke out on Monday, held those gains Tuesday. It closed above it’s February high!

For more on it check out my first post on it here.

I talked with Jim Goddard of www.howestreet.com about this impending breakout in gold and mining stocks that appears to be lining up on the charts.

Market futures are flat this opening. For more on my trading methods grab my book Strategic Stock Trading.

-Mike

Disclosure: Mike Swanson owns shares Pacific Ridge Exploration. Because Pacific Ridge Exploration is a small cap stock with a market cap of less than $100 million he has put himself in a trading blackout on the stock and will not buy or sell a share of it for at least 30-days from the date of this post (04/04/2021). Wallstreetwindow.com, is owned by Timingwallstreet, Inc., which is being compensated by a third party (Leadgopher LLC DBA Pinnacle Ad Network) to conduct an investor awareness advertising and marketing campaign for Sonoro Gold Corp. This third party paid Timingwallstreet Inc., $16,000 to produce and disseminate this and other similar articles and send traffic to them through paid advertising campaigns for 30-days from the date of this post (4/04/2021). This compensation should be viewed as a major conflict with our ability to be unbiased, more specifically: This communication is for entertainment purposes only. Never invest purely based on our communication. For more on trading risks read our policy statement by clicking here.