In my blog post yesterday I said that the stock market was churning. This means that it isn’t in a big powerful uptrend like we saw from April to Labor Day last year or from after the election to this mid-January. It means the major indices are basically going sideways and are in a trend with many whipsaws that makes it very difficult for people trading ETF’s based on the averages such as DIA, SPY, or QQQ to make money. It’s also a time when past winning sectors can fade as money rotates into new trends.

Churning markets can last for weeks and months, but when they end you see new market leadership emerge to drive the next upward swing and often you’ll see past winners suffer from periodic bear attacks as the process carries out. This is now what is happening in the markets.

From the start of the year we have been seeing strength in new pockets of the market and weakness in what had been big winning stocks and trends for 2020 until they peaked and began to lag. Now on down days those fad stocks that had been lagging the market have been getting hit hard as you may have noticed yesterday. Whether this is all the makings of a mega top or a great rotation doesn’t matter, because either way the fad stocks that are lagging are becoming toxic to hold on to.

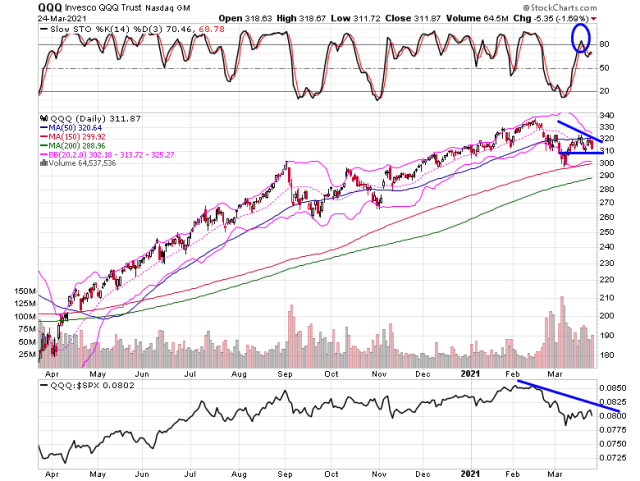

The easiest way to see this is in the dichotomy of the performance of the Nasdaq 100 in comparison with the S&P 500. Check out the QQQ ETF chart.

The Nasdaq 100 index fell down to its 150-day moving average, after peaking in February, and then bounced back up into its 50-day moving average. That bounce was big enough to get its daily stochastics overbought, back above 80 for a moment, even though it stalled out. Now selling came back into the Nasdaq 100 yesterday. What is more important, though, is that this ETF, which is heavily weighted with big cap tech stocks, began to lag the S&P 500 around Labor Day and then dumped hard in February. When something lags on a big market rally when that rally starts to lose momentum it often falls hard.

That’s exactly what happened with the Nasdaq 100 a few weeks ago and with fad stocks such as TSLA and funds like ARKK, which is wildly invested in some of the most highly valued fad stocks.

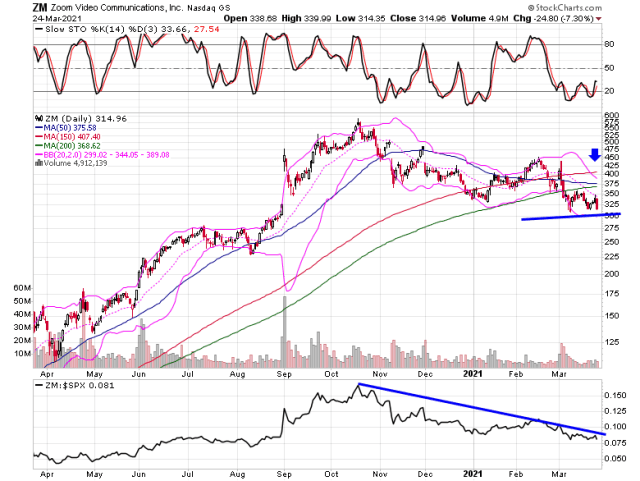

In the chart above notice how the QQQ/$SXP relative strength ratio is now trending down. The same thing is happening with TSLA and ZM.

In my interview with Jim Goddard of www.howestreet.com on Tuesday one of the things I said is that investors need to sell the stocks that were huge winners in 2020 that then dumped on the recent market pullback and are now lagging the S&P 500. I mentioned Zoom as an example of one such stock. Zoom was last year’s big fad. But it’s last year’s story and not the story of tomorrow. And now it’s stock is lagging.

My idea is to sell such stocks and move that money into future leading sectors, or at least just sell and put the money in cash and wait until this churning market trend ends, because as long as it goes on you’ll see the fad lagging stocks get hit hard from time to time so there is no reason to keep holding on to them.

So to sum this up – sideways markets churn portfolios over and can hurt people trying to actively jump in and out of them. They also hurt people who invested in past winners whose winning streak have come to an end, because such stocks get beaten down over and over again on down days as funds get out of those winners to use that money in future winners or to put the money into cash to reduce risk for the time being.

I believe this is what most people should be doing now. They need to reduce risk and volatility in their accounts and the best way to do it is to get out of these fad broken lagging stocks.

I know that in the financial world almost no one will ever tell you to sell anything, because frankly it creates a lot of anger and blow back, because people want to hear that their stocks are going to go up and want to be told that they are right to be owning what they are owning. But those owning stocks like TSLA and ZM were indeed right to do so last year, but no longer are. Trends change. Churning markets are markets saying things are changing. New trends will come out of the end of this as past trends that now have broken charts continue to see selling. Stocks that win one year often lag the next year. Anytime now, no matter the day, is a good time to sell the ARKK ETF. It’s like the Janus fund back in 2000.

And all Alexas must be destroyed. Here is one man liberating himself!

Disclosure – I have a short position in ZM at the moment; I tried to short TSLA, but could not get shares of it. I have more long positions than short positions, but think for myself having some shorts now is a way to do some hedging in the market as a way to reduce risk. The easiest way to it reduce portfolio is to simply raise cash reserves to be able to buy new things with later – and GET OFF MARGIN!

-Mike