Cold rain is falling outside of my window and is supposed to continue for the rest of the day. When this happened last weekend my power went out for about ten hours and thousands of people around me lost their electricity for days. I hope it doesn’t happen again, but if I disappear from the comments section on the bottom of this post later today that is why.

In a few hours we are going to get the Congressional Gamestop short squeeze hearings on TV. There will be a lot of posturing and playing for the cameras just as there was two weeks ago when talking heads and politicians of all stripes played on the false narrative that the story around the stock represented the battle of the little guy against systemic corruption when Robinhood and several other online brokers restricted trading in the stock, only allowing them to buy a few shares.

The narrative was completely false (in fact it was giant hedge funds that went long the stock and made the most money) and it was sickening to see so many repeat this meme over and over just for attention or to be ratings “leaders” in the news cycle. It was a glaring example of how rotten the news cycle is, full of propaganda and nonsense with no care if what is said is real or not.

Yesterday, the CEO of Interactive Brokers was on CNBC and said that the Gamestop situation could have taken down the financial system if it had continued. It wouldn’t have been just a few hedge funds that failed, but brokers and their millions of customers accounts. Brokers act as banks when they lend securities and grant their customers margin. So, if everyone is margined up on some bubble stock and it collapsed the whole firm could go under just like many banks did in 2008. At one point AMC was the most owned stock among Robinhood app players and Gamestop was 12.

This IS why the brokers limited trading in Gamestop. It is also why the record growth in margin debt happening in the markets is increasing risks in the market and is dangerous. Tell that to a gambling addict on Robinhood though and they will just mad at you.

If out of this hearing came a rule by the financial regulators to INCREASE margin rates slowly to shrink it down to normal it would be a wonderful thing for everyone, but they won’t because these are not leaders, but people who are only running this hearing to be on TV and play to the crowd. Maybe someone will speak out for a few moments to make it worthwhile, we can hope.

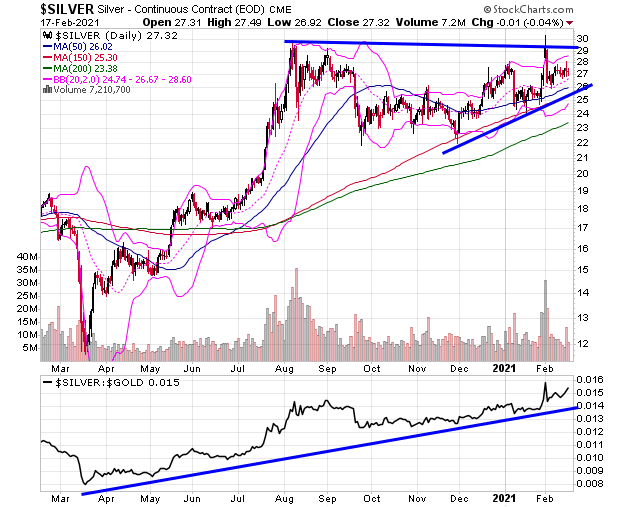

As for the markets, the biggest thing happening is the slow motion rise in bond yields. This has put a damper on gold prices for now, but other metals markets and commodity stocks continue to go up and up. Silver for one is holdings its gains of the other week and is outperforming gold.

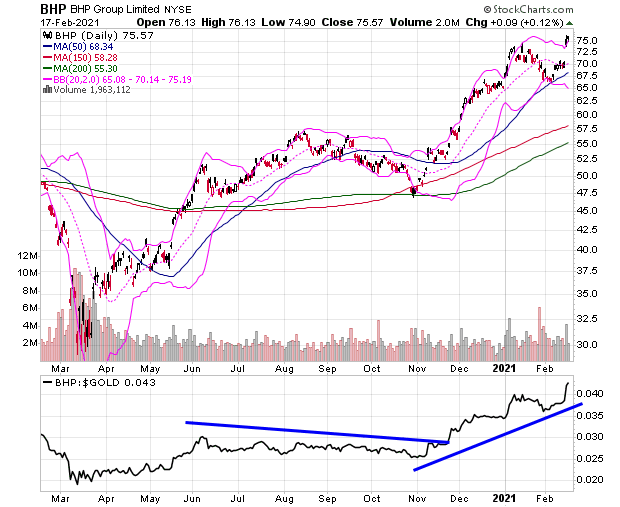

This action in silver relative to gold suggests that silver will lead both on the next big rally in the precious metals market. Meanwhile, copper is going up even faster than silver to help fuel big moves in materials stocks such as BHP Group.

I own shares of BHP and also XOM, which went up again yesterday.

XOM had been lagging gold and the entire stock market for years, but began to come alive in November. My stock pick of this month is involved in not only gold, but silver and lithium too, and just did a uranium deal yesterday so it is positioned well spread out in several things.

On Tuesday I did a live trading session with David Skarica of www.addictedtoprofits.net.

I started something new this week and that is I am opening up my daily morning posts at the bottom for comments. My goal is to make this a water cooler type spot where we can talk about the markets together and share ideas. Check it out. If you got any questions or comments just scroll on down to the bottom of this post. It’s fun.

-Mike