Yesterday Janet Yellen testified to Congress. No she didn’t do it as the Federal Reserve Chairman, but as the new head of the US Treasury. It seemed funny to see her back in action as if nothing has changed. We are getting used to the world we are in now in which interest rates are near zero.

She told Congress to “go big” on stimulus and not to worry about the US budget deficit, because it is simply necessary with so many people suffering and the US economy in tatters after last year. Stock market investors are used to the idea of rates being zero and the Federal Reserve has pledged not to raise them anytime soon, although it says it wants to see the inflation rate to get above 3%.

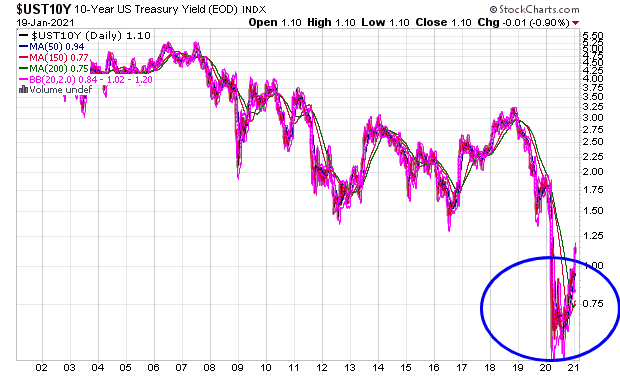

But if we step back from the daily news and look at the big picture on the charts it looks like we actually have seen a secular low in long-term Treasury bond yields last year – just as we saw a record low in oil prices (remember they went negative) and a secular turn in the price of commodities across the board.

Check out this chart of the yield on the ten year Treasury bond.

This is a chart that looks like a double bottom. That means that the natural trend for bond yields is to go up over the next few years, but the Federal Reserve cannot allow rates to go back to up to where they were in 2018 or 2019, because if they went that high then the country would basically go bankrupt, because the size of the debt has exploded.

And so last year the Fed Chairman Jerome Powell has talked about one day instituting “yield control” in which the Fed would buy long-term bonds to prevent these bond yields from going too high. That would be a program in which the Federal Reserve would buy Treasury bonds across the board at all durations necessary.

The day this happens this will be the defining event for the markets for the next decade and will cause the dollar to fall even more and the price of gold to rocket higher, because it is the movements in the dollar that most impact the price of gold, not Bitcoin. With the US dollar now working off an oversold condition after its sharp December drop, gold is trending sideways in a consolidation zone that it has been in since August, because of its volatility price structure.

Coming into this year I had assumed at some point we would see a correction in the stock market in the second half of this year that would come with it a decline in corporate bonds, which would cause the Fed to take action and increase their QE bond buying program and announce yield control.

This could still happen later, but it’s also possible though that it doesn’t take a sizable correction in the stock market to bring that about, but instead a simple rise in the ten year Treasury bond yield up to the 1.50-1.60% that causes the Fed to just do it.

It’s just a question of what takes us from here to the day that yield control begins. We can’t predict how things will exactly play out, but instead need to take one week at a time and see how the market trends unfold and change.

Here a closer look at the ten year Treasury bond yield on a one year chart.

On a short-term the bond yield is overbought with the RSI recently popping above 80. So it will likely take months for the yield to get into the 1.40% – 1.60% range.

BTW – the folks at Sonoro Gold, my top stock pick for this month, are going to run a live webinar tomorrow at 1:30 PM (PST). They will discuss the recent series of drilling & metallurgical results from the Cerro Caliche project site. After there will be a live Q&A session. To register click here.

-Mike

Disclosure: Mike Swanson owns shares of Sonoro Gold Corp. Because it is a small cap stock with a market cap of less than $100 million he has put himself in a trading blackout on the stock and will not buy or sell a share of it for at least 30-days from the date of this post. Wallstreetwindow.com, is owned by Timingwallstreet, Inc., which is being compensated by a third party (Leadgopher LLC DBA Pinnacle Ad Network) to conduct an investor awareness advertising and marketing campaign for Inca One Mining. This third party paid Timingwallstreet Inc., $10,000 to produce and disseminate this and other similar articles and send traffic to them through paid advertising campaigns for 30-days from the date of this post (1/04/2020). This compensation should be viewed as a major conflict with our ability to be unbiased, more specifically: This communication is for entertainment purposes only. Never invest purely based on our communication. For more on trading risks read our policy statement by clicking here.