Over the past few months we have witnessed a consolidation/correction phase play out in mining stocks and the price of silver and gold. Last week it picked up steam when gold fell through $1850 an ounce, which had been support on it since August. This put everyone who had bought in the past few months in a loss and anyone on margin in complete danger.

The result was intense selling that took gold down to $1800 and then down to $1776 on Friday in what was an over $30 panic sell on the morning open.

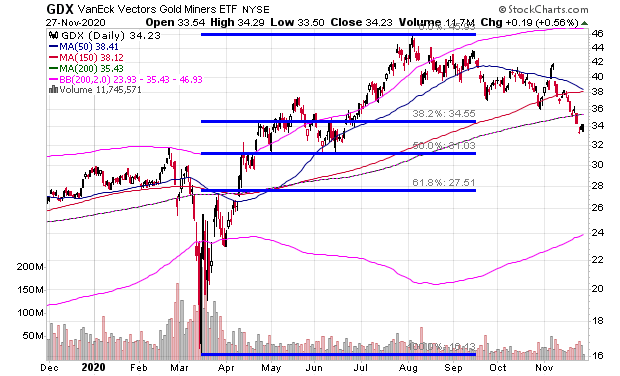

Gold has essentially taken back 50% of the gains made from the March low and August peak as you can see from this chart.

One interesting thing about the dip in gold and silver is that it while it has happened other commodities have gone up and the US dollar has continued to trade weak – so when it comes to the commodity complex the gold dip is not a sign of some massive new macro trend, but instead a simple trading correction. In fact, seasonally, gold tends to have its worst month in November and best two months in December and January.

This seasonal pattern is likely to play out again, because on Friday gold stocks put on a positive divergence to signal a buy signal and end point to this metals correction.

The action in gold stocks, and the GDX ETF as a proxy, tend to lead the action in gold. So what happens during the start of a gold correction is that the GDX tends to begin to act weaker than the metal, but then when it gets to an end the GDX falls less than the metal or even goes up as gold goes down more.

That began to happen last week and when Friday came to an end, with panic selling in gold, the GDX ETF gapped down in the morning to finish green for the day, with some mining stocks up over 4%. In other words as gold fell $30 off the open buyers came into mining stocks seeing this as the bottom.

This is a huge is that sign that we are now in a strong buy point for gold, silver, and mining stocks. It doesn’t mean that they are going to just go straight up. It may take a week or two of some basing action before they really get running, but the reality is no one can predict exact price tops or bottoms before they happen. All you can do is see the turn as it starts and go with it and that turn is now here.

I own the GDX ETF and many individual mining stocks. One small cap mining stock that I have a position in is Great Thunder Gold (OTCMKTS: GTGFF).

Notice how this stock is still up this month even with the drop in gold and remains near its recent high. That’s a sign of powerful relative strength and what you want to find when you pick out stocks in a sector to buy. I first profiled Great Thunder Gold at the beginning of November when I made it my stock pick of the month.

You can find my full profile on Great Thunder Gold by clicking here.

-Mike

Disclosure: Mike Swanson owns shares of Great Thunder Gold. Because it is a small cap stock with a market cap of less than $100 million he has put himself on a trading blackout on the stock and will not buy or sell a share of it for at least 30-days from the date of this post. Wallstreetwindow.com, is owned by Timingwallstreet, Inc., which was compensated by a third party (Leadgopher LLC DBA Pinnacle Ad Network) to conduct an investor awareness advertising and marketing campaign for Great Thunder Gold. This third party paid Timingwallstreet Inc., $18,000 to produce and disseminate this and other similar articles and send traffic to them through paid advertising online campaigns for 30 days beginning November, 2020. This compensation should be viewed as a major conflict with our ability to be unbiased, more specifically: This communication is for entertainment purposes only. Never invest purely based on our communication. For more on trading risks read our policy statement by clicking here.