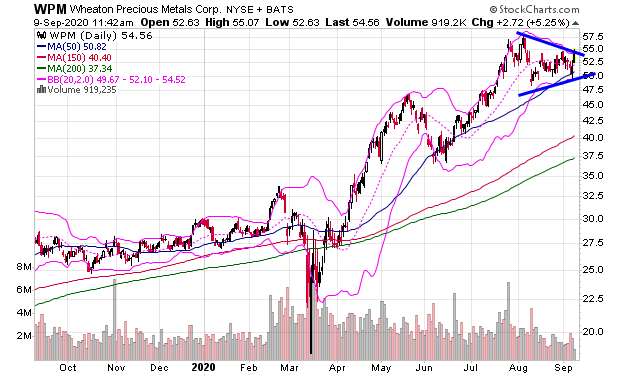

While the S&P 500 and Nasdaq are rallying today after several days of tough selling, shares of Wheaton Precious Metals (NYSEARCA: WPM) are doing more than simply rebounding as they are breaking through a technical triangle chart pattern. This is a simple “flag” pattern that typically represents a consolidation pause in a larger bull trend. Take a look at the chart.

Shares of WPM soar sinced March and paused in August and September to test its 50-day moving average. It is now trading above its most recent September high to display positive price action. The stock is outperforming the S&P 500 to be one of the top stocks in the financial markets.

It is doing this because it operates major silver mines and the price of silver has also done well this year. Rising silver prices are helping Wheaton Precious Metals increase earnings and revenue when most companies are doing the opposite in the recession. Marketbeat.com reported that a few weeks ago “the company reported $0.22 earnings per share for the quarter, beating the Thomson Reuters’ consensus estimate of $0.19 by $0.03. Wheaton Precious Metals had a return on equity of 5.59% and a net margin of 13.88%. Equities analysts anticipate that Wheaton Precious Metals will post 0.98 EPS for the current year.”

I own shares of WPM and see mining stocks as a big winning stock play for this year in a time in which now so many big cap technology stocks are overbought and more risky than ever. I had a conversation with David Skarica of addictedtoprofits.net yesterday.

We saw Warren Buffett take a big position in Barrick Gold last month. I’m also closely watching my top stock pick of the month today as it is a small cap mining stock in a similar position. This is the time. If you are not on my free stock trading email list subscribe now by clicking here.

-Mike