Aftermath Silver (OTCMKTS: AAGFF) is a stock I first bought back in June of last year and have wrote about from time to time. It was a small cap mining stock trading under 8 cents a share back when I first found out about it and today is trading close to 68 cents on the US OTC. That’s a massive gain that only a few stocks have been able to achieve during that time. It’s been due to smart management, rising silver prices, and a new summer deal that amounts to what I saw as a “triumph” for Aftermath’s shareholders when I last mentioned the stock on July 31st, 2020.

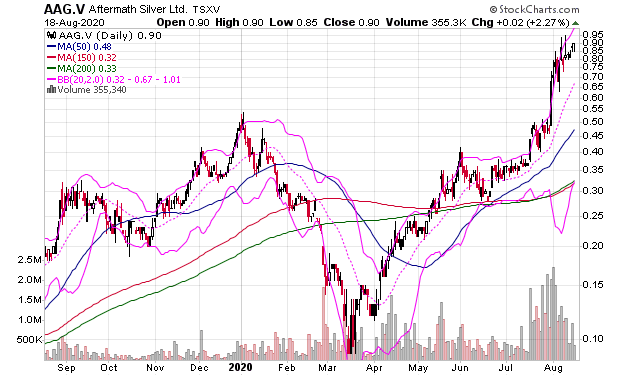

The stock’s main listing is on the Vancouver stock exchange and at the end of the July it was trading there for 47 cents. Today it closed at 90 cents! The market has liked this deal to say the least. Take a look at the chart.

Now what the deal amounts to is the acquisition of a large silver project in Peru. Robert Moriarty of 321gold.com described it this way – “If you are a silver bug, Aftermath Silver Ltd. (AAG:TSX.V) just did a binding agreement on a project in Southern Peru with a silver 43-101 resource of 126 million ounces. They are paying about $14.5 million in total in USD with a tiny NSR on production. It comes with 771 million pounds of copper in a 43-101 resource for free.”

“Alternatively, if you are a copper nutcase rather than a silver nutcase, you can think of Aftermath paying $0.02 a pound for a 771 million pound copper resource that comes with 126 million ounces of silver for free. That seems like a pretty good deal to me,” writes Moriarty.

In Moriarty’s view “this its going to go down as the deal of the century for Aftermath.”

Well I don’t know if it will be the deal of the century as I don’t know what will happen in 2090, but I can tell you it sure is exciting so far! Jordon Roy-Byrne told his pay subscribers in an update that “With its recent acquisition, Aftermath Silver is now the clear best silver optionality play. It has the best combination of size (close to 200M oz Ag) and grade.”

Aftermath CEO Ralph Rushton gave this interview about the acquisition and more earlier this month.

The people at Aftermath also put together an updated company presentation about the stock that includes the impact of this July deal. Check out this comprehensive company presentation PDF and take a close look at pages 9-10 and the comps:

With silver prices in a bull market its hard for me not to be excited about this.

-Mike

Disclosure: Mike Swanson owns shares of Aftermath Silver. Because it is a small cap stock with a market cap of less than $100 million he has put himself in a trading blackout on the stock and will not buy or sell a share of it for at least 30-days from the date of this post.