To beat the market you want to be in the best stocks in the best sectors of the stock market. So far this year gold and the mining stocks have vastly beaten the performance of the DOW and Nasdaq even though yesterday saw a dip in the price of gold.

Some saw it coming. Last week a lot of people were forwarding me links to various predictions for a collapse in the price of gold or a big drop. The gold rally that began in June when gold smashed through $1350 seemed to run out of momentum once it got to $1550 and so the crash callers came out.

However, what is happening is a simple consolidation pause for gold and silver. Frankly I thought it was going to start to pause like this earlier this month, but it is happening now instead. Gold was stronger than even I thought it would be, but the silver rally also has been bigger than everyone expected too.

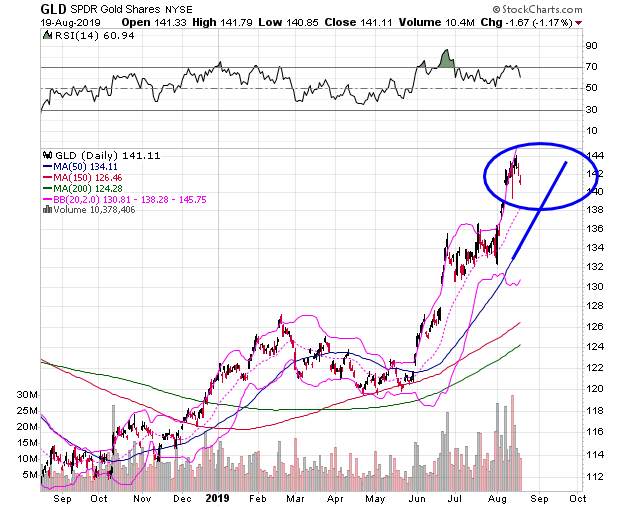

Take a look at the gold chart now.

Notice that the RSI momentum indicator for the price of gold began this month with an overbought reading over 70. The last time it did this in June when gold got near $1450 the price of gold consolidated for about a month before breaking $1450 to surge again.

Don’t be shocked if we don’t see another period of consolidate for a few weeks here into the September FOMC meeting for gold before the next run through $1550 and beyond.

If you missed this run and are looking for an entry point I’d look for a dip in gold to its 50-day moving average. That doesn’t mean gold is going to fall to $1425 though as this moving average is going up now every single day and will be at $1475 by Labor Day.

Of course the easiest way to buy gold in a brokerage account is with the GLD ETF – the SPDR Gold Shares trading on the NYSE.

If GLD simply goes sideways then it will hit its 50-day moving average in the 138-141 area by Labor Day.

There has been a minor pullback in most of the big cap mining stocks in the past few sessions, but the big cap miners are holding strong and are not forming a negative divergence against the metal. This confirms that this is a simple pause in a bigger bull trend and not a major top.

Of course you know that as gold tends to go up when the Federal Reserve goes through a cycle of lowering interest rates and launches when the yield curve inverts as has happened again.

While big cap miners are consolidating as a group there are actually small cap mining stocks that were lagging in June and July that are now simply breaking out on there own.

Aftermath Silver even closed right on its 52-week high yesterday with gold and silver falling. It remains my top pick for this month, but there are others I am looking into too. A period of consolidation in gold and silver will give those that missed the move a chance to get in with a decent entry point and those of us who want to buy more a time to get into some new positions for a run into the end of the year! People are starting some big plays in the mining industry.

-Mike