I’m doing less posts about the markets right now. For one thing not a whole lot is going on, but there is also a big problem with the internet now. The posts that get pushed on Google and Facebook, and videos shown to people on Youtube, are those that tell the most number of people what they want to hear. It’s all about getting the most clicks and views. That’s why everything you see in the financial media now is about NVDA stock. Look at the main financial websites every morning and you’ll see a headline about it and about Tesla and Elon Musk. Sectors that provide value and look to be ready to begin a new move are of zero interest to the most number of people, because they haven’t moved yet, so they aren’t in the news and the internet algorithms drown out stories about them with stories about what people are chasing in the markets – the things that have ALREADY gone up a lot.

I’m tired of the internet – it’s now flooded with nonsense more than ever, because people fill it with garbage to cater to the algorithms for money. Take a look at the Maui fires. There are thousands of videos being created claiming that the fires on that island were created by space lasers by people looking to say anything for views. There are garbage theories about it and the people making these things do not care if what they say is true or not.

How many people got fooled by what they saw on the internet into thinking that Bitcoin is money?

Bitcoin cannot function as money, because every time you use it you get charged a giant transaction fee. What that means is that if the Bitcoin was used as the only currency the money supply would shrink rapidly (collapse in a week) and it would create a global depression.

Not a single Bitcoin/crypto promoter has ever mentioned this problem anywhere.

Where is “RealVision” still peddling it’s crypto nonsense for the views and clicks….

When “Realvision” rose up to become a big player in the Youtube financial media niche it meant that the medium itself was degrading.

My answer is to spend less of my time on the internet – reading it or doing anything on it.

It has become an unreal place.

I have not done a single “Tweet” all year and do not miss it.

If you have a Twitter account or X, whatever it is called now, deleting it can be one of the best things you can do for yourself.

If you do it you’ll see in a few months you don’t miss it at all.

It’s just wasting your time.

Someone sent me an email asking which app to use for the stock market.

My answer to them was that if they use an app to try to beat the markets they are basically putting a blind fold on – as there is very little meaningful information on the apps – they just show prices going up and down – and that’s about it – to make you trade more. You need to spend a few hours a week looking through charts and reading articles to understand what is going on. An app is useless for a serious trader or investor who wants to win. What apps do is bring the dumb money into the market that creates the profits for everyone else.

Anyway, this is a post that few will know even exists outside of people already subscribing to my email list.

Commodities have been going sideways all year and now look like they are about to turn up and start to rally. Take a look at the CRB Index.

The CRB index is in the same position that shipping stocks were in back in July (breaking out of a sideways consolidation phase).

Take a look, for example, at ESEA. It’s a stock I mentioned as a breakout candidate in a post back on July 30th as being in a sector ready to breakout and surge. And it did.

I own ESEA.

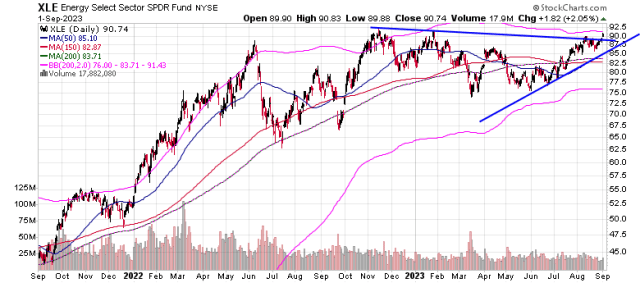

Now the sector that looks like it is ready to run to me are energy stocks. Take a look at the XLE energy stock ETF.

The CRB index is heavily weighted by oil and energy. Energy stocks as a whole, have performed better than the price of oil, which went through an almost twelve month long correction, that appears to have ended.

To name two energy stocks that I own take a look at COP.

And also XOM….

There are over 200 energy stocks you can look through with similar charts, some of which are paying big dividends.

The way they are positioned makes me think that it is highly likely that this sector is going to have a strong rally into the end of the year, and probably the first 3-6 months of 2024, regardless of what the S&P 500 does. If there was one sector I would buy now this would be it. In fact, I still believe that the overall market averages are not likely to do much of anything, but trade in a narrow range for the rest of this year.

One implication – if energy and commodity prices rally from here that means that the rate of inflation is not going to fall anymore from where it is now. I know Cathie Wood said in 2021, when the Federal Reserve said that inflation was “transitory,” that we would have deflation on RealVision because of things such as the technology built in Tesla cars. She was wrong in her belief that computers were perfecting the world, but it was what the RealVision audience liked to hear, and such talk helped her drive billions of dollars into her funds from people investing with apps. She became so big, pushed by the algorithms, that she became a regular guest on CNBC and Bloomberg – where just a year ago she still talked her deflation nonsense.

Historically, there is a sector rotation pattern to which sectors perform the best at which stage of a bull market you are in and energy stocks typically are leaders in the last innings of one. This isn’t a bull market like you saw before 2020, but a short-lived cyclical bull cycle, that is likely to end next year, perhaps after the Presidential election.

I did an interview with Jim Goddard of www.howestreet.com last week, mostly about the broad market. You can listen to it here.

Some good news – a small town in Ireland has banned cell phones for children! Not only won’t they be allowed to bring them in schools, but the parents have agreed to not even let them own them. They will be protected from social media madness and the rotting effects the internet has on people’s brains. I doubt you’ll see posts about this news on Twitter or Facebook as I doubt the algorithms will want you to know about them, but when you look elsewhere to see what is going on you can find good news.

To subscribe to my free stock trading updates and news digest click here.

-Mike