The much anticipated 15th BRICS (Brazil, Russia, India, China, South Africa) Summit has begun in Johannesburg, South Africa. As expected, a central topic is challenging the global dominance of the dollar in international business and trade. Russia and China are leading an effort to not only strengthen cooperation between the five nation BRICS core but to expand the membership of BRICS into a ‘BRICS+.’ An estimated 40 nations have indicated an interest in joining the current BRICS bloc.

The current dedollarization wave began shortly after the Russian invasion of Ukraine in February of 2022. Among a raft of other sanctions, Russian financial institutions were ejected from the SWIFT messaging system and hundreds of billions of Russian-owned dollar reserves were seized. In addition, a litany of globally disruptive policy missteps by the Federal Reserve in the wake of the COVID pandemic have inflamed wide anti-dollar sentiment. The incommodious debt ceiling maneuvers in May 2023, followed by the second-ever downgrade of the US credit rating, have only fortified the case of dollar oppositionists.

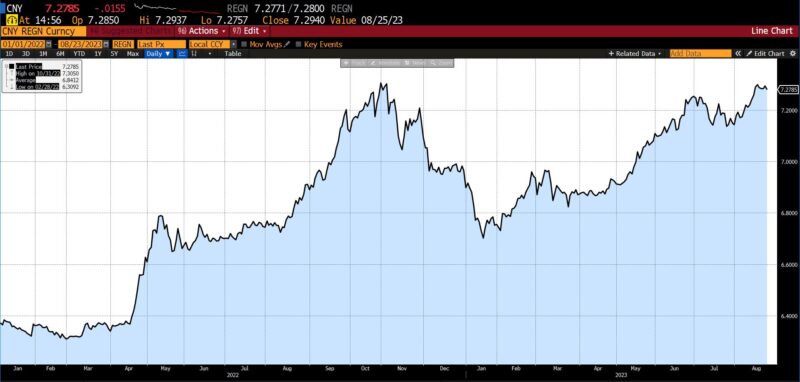

CNY USD spot exchange rate (2022 – present)

(Source: Bloomberg Finance, LP)

The list of nations expressing their desire to join the current BRICS group is geographically farflung (Kazakhstan versus Cuba), economically diverse (Argentina versus Indonesia), and culturally/historically contrasting (Bolivia versus Ethiopia). But some would undoubtedly have more consequential effects on the goal of creating dollar alternatives than others. The inclusion of Saudi Arabia, United Arab Emirates (UAE), and a handful of other oil producing nations would bring not only economic heft but the possibility of short-term, drastic changes in global oil markets pricing and settlement.

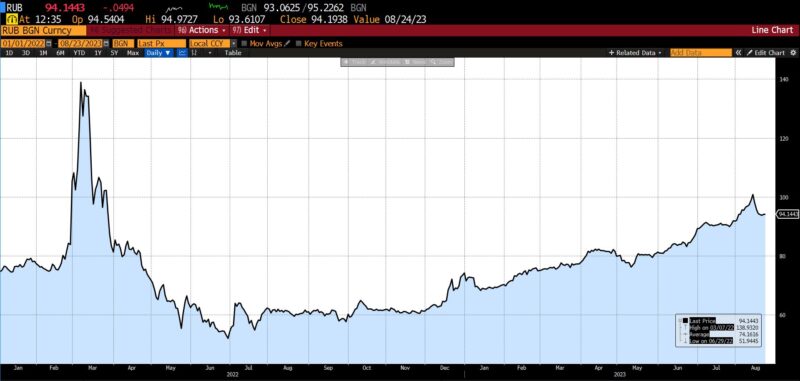

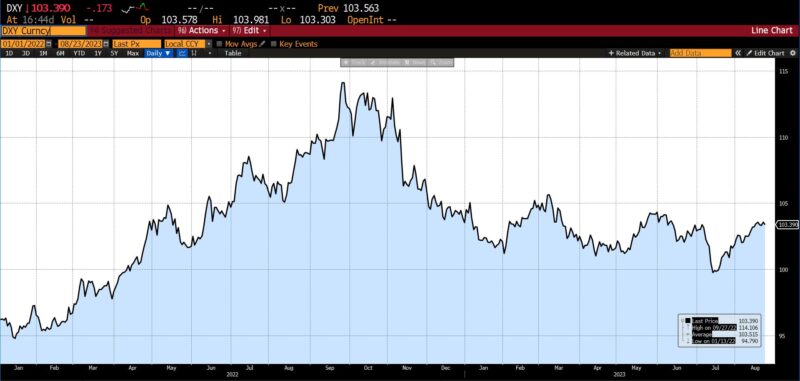

A first step in distancing from the use of the dollar would be trading in local currencies. An example of this was seen two weeks ago when India executed its first oil trade with the UAE denominated in rupee. That test having been successful, a real-time payment system between the two nations is currently in development. But low trading volumes and volatility make trading in terms of smaller, less liquid currencies challenging and potentially costly. The drop in both the value of the yuan (down 5 percent YTD) and the ruble (down 16 percent YTD) have, additionally, reduced the standing of their respective governments as sagacious monetary administrators. (By comparison the dollar, as measured by the DXY index, has risen 1.1 percent since January 1st.)

RUB USD spot exchange rate (2022 – present)

(Source: Bloomberg Finance, LP)

Anticipating these criticisms–or perhaps in light of them–more recent proposals have suggested BRICS+ avoiding dollars by trading in precious metals or through a commodity-backed currency. Central banks around the world have been purchasing gold at record levels over the past year or two owing to the return of first-world inflation and post-COVID economic strains. Another idea that has been bandied about, both with respect to escaping dollar hegemony and to combat dedollarization, is the development of stablecoins in various forms.

As with any political jamboree, especially one so widely watched by allies and adversaries alike, the first day of the BRICS Summit has been illustrated by grandiose speech: about a “spirit of openness” (Xi), about the progress of dedollarization being “objective [and] irreversible” (Putin); and about creating a “multilateral institution, not an exclusive club” (da Silva). Talk aside, the percent of global GDP accounted for by the BRICS nations has recently overtaken that of the G-7. With the addition of new nations, which could be announced within the next twenty-four hours, the GDP representation of the BRICS+ amalgamation may dwarf the latter. At the same time most of those nations have only an ephemeral fealty to private property rights, formidable capital controls, are avowedly interventionist, and admit a host of other features which make them less-than-desirable places to do business, much less reserve-currency issuers.

Competing narratives of the dollar’s future are being sketched simultaneously: not only in Johannesburg, South Africa but 9800 miles away in Jackson Hole, Wyoming. Which of those conflicting visions comes closest to realization, or whether another eventuates, remains to be seen. The fragility of the moment is even better conveyed by noting that while Argentina has expressed a desire to join BRICS and is in attendance at the meeting today, it is dollarization, not dedollarization, which is actually taking place at home. (The significance of India being the first nation to land a spacecraft on the south pole of the moon–also today–can be incorporated at the reader’s discretion.)

DXY Index (2022 – present)

(Source: Bloomberg Finance, LP)

The US dollar is likely to remain a reserve currency for a very long time: technology, institutions, and practices have entrenched in it that role. It may, as it did with the British Pound for several decades, share that spot with another, or other, currencies. Indeed, a newfangled BRICS+ currency may find a place alongside it or them, whether its use owes to superior monetary properties or simply a desire to spurn the use of the US dollar.

However long that takes to occur and even if it doesn’t, the contours of international financial relations are changing rapidly, perhaps irrevocably. Far more important than verbal fusillades or untenanted financial statistics are two decisive factors. The first is, even as inconsistent as it has become, a continued commitment to free market practices in good times and bad. The second, even more critically, is a return to sound money. The enduring robustness of the US economy depends upon both–regardless of the pecking order of global reserve currencies.

THIS ARTICLE ORIGINALLY POSTED HERE.