What will the stock market in Vietnam do in 2023?

American investors can invest in it through the VanEck Vietnam ETF (NYSEARCA: VNM). This ETF consists of 59 holdings and “seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® Vietnam Index (MVVNMTR®), which includes securities of publicly traded companies that are incorporated in Vietnam or that are incorporated outside of Vietnam but have at least 50% of their revenues/related assets in Vietnam.”

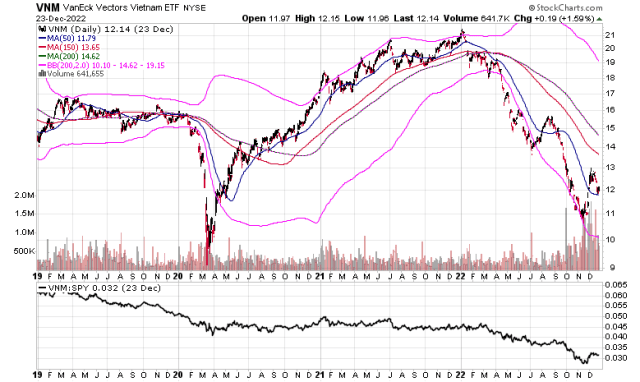

So far, in 2022, it has fallen over 42%, but it has put on a nice rebound this December.

The VNM ETF is in a technical stage four bear market, but is likely to enter a stage one basing phase in 2023.

Many are looking forward to a strong bull cycle in Vietnam. According to VietnamNet, “The US dollar has shown signs of corrections after several peaks. Meanwhile, China has launched measures to support the real estate market and has sent signs of opening the economy after strengthening additional Covid-19 vaccinations.”

Investors are eyeing Vietnam, because The World Bank has “recently assessed that the country will be the leading economy in the East Asia-Pacific region with a growth rate of 7.2 per cent in 2022 and 6.7 per cent in 2023.”

The creation of the VNM ETF and several other vehicles for investors has helped created heavy inflows of money into the Vietnamese stock market. According to Vietnam Economy News, “VNDirect Securities Corporation said that the emerging and frontier markets’ exchange traded funds (ETFs) net bought more than 1.7 trillion Vietnamese shares in just one month. From around mid-November, the Vietnamese stock market experienced a strong recovery from the long-term bottom, boosted by great motivation from foreign investors. Besides the return of disbursement of large active funds such as Dragon Capital and VinaCapital, foreign capital inflows into the market via the ETF channel also witnessed positive movements. Funds, including Fubon ETF, FTSE Vietnam ETF, V.N.M ETF, and especially iShares MSCI Frontier and Select EM ETF, are continuously net buying. The IShares MSCI Frontier and Select EM ETF are ETFs that specialise in investing in frontier and emerging markets. Since November 15, iShares MSCI Frontier and Select EM ETF have net bought approximately $234 million, equivalent to VNĐ5.850 trillion.”

Such inflows can simply drive up the entire stock market when the next bull market cycle begins. Eleven Apple supply chain companies have relocated from Taiwan to Vietnam and Lego opened up a one billion dollar plant there. FoxConn is constructing a $300 million factory in the country that will employee 30,000 people to produce Apple Watches and and MacBooks. It was the best performing economy in the region with the impact of foreign investment. This is why many foreign investors are keeping a close eye on the country.

To get my next market updated subscribe to my free email list by clicking here.

-Mike