As you know if you have been following what I had been saying about Gamestop (NYSE: GME) on various podcasts I was on recently, I never bought into the narrative pushed by just about everyone on television, and even politicians, that it was a story about some small traders fighting against giant hedge funds that got victimized by Robinhood and the street. I did a rant on all of this on The Ochelli Effect on Tuesday.

And now Gamestop crashed again on Thursday after crashing Tuesday killing all the people on Robinhood who piled into the stock to drive it up to become the 8th most owned stock on there – and they also took AMC to the number one spot, which is crashing too now.

It wasn’t small fries who won. They had no chance to destroy the hedge fund industry by shorting the stock, because it was other giant hedge funds that got in way before they did. The “kitty” character on Reddit was simply acting as front for these hedge funds lions whether he knew it or not. It is funds like Permit Capital that won.

The small fry who thinks they can make money by getting on a message board and becoming a member of a herd has no chance in these markets.

Now I want to tell you what Gamestop really reminds me of – and that is Books-A-Million.

Like Gamestop it’s a junk company and a hellhole.

Go in a Gamestop and see if you think it has a bright future.

The last time I went in one was over 10 years ago and it was dark inside and the workers were weird and I got creeped out. They were internet kids who never go outside so they were all pale and sickly looking.

Well, like Gamestop, Books-A-Million is an obsolete retail chain that is a hellhole. In 2014 an article on Anerican City Business Journals identified it as America’s worst company to work for, citing low satisfaction among employees due to “high stress and low pay…low chance of promotion, [and] hours are based on magazine and discount card sales.”

The employees feel like zombies, because when they are in a Books-A-Million everything around them is dying. There is no energy in the store, because there are no customers.

In 1998 Books-A-Million was in trouble from the competition from Amazon and other retails simply doing a better job and the CEO found a way to take the stock from $3 a share to $47 a share in the space of three days.

The move caught the attention of all the financial media for three days just like Gamestop just did last week.

And then within a week it crashed back down to $3.00 just like that.

The move attracted tens of thousands of daytraders on the way up who got crushed holding the bag on the way down.

I didn’t buy it or get caught up in it, but I watched it and never forgot, because it was so crazy. There are some things you see in the markets you just never forget.

What the company did was simply announce that it was going to launch a website to sell books. At the time any company that announced it would sell on the internet would go up just about and it went up, with shorts getting squeezed too.

That is what people bought into back then.

Never buy a stock or anything on the basis that a short squeeze will make it worth buying, because when short squeezes end the stock always crashes.

That’s what happened with the famous silver squeeze of 1980 too. The time to buy silver back then was in the years before 1980.

WallStreetBets couldn’t squeeze silver and so all it did was gap up on the hope they could on Monday (and it was a big gap up) and then silver took back those gains.

Now gold and silver are set just as they were a week ago to continue to consolidate in a range as they had been doing since August.

Maybe it’s good a silver squeeze didn’t take place, because then we’d have to worry about what happens when it ends.

Because all short squeezes end in disaster for those that buy into them.

They always have.

But such history didn’t matter to someone opening up a Robinhood account and putting in a trade for the first time or someone caught up in the hype of a Reddit message board.

It didn’t matter to them that it was giant hedge funds they were helping buying the stock when they heard someone on the radio or the TV repeat a little guy against the system story that they just wanted to believe in.

And now many are crying.

They were not victims. This was not a story of small traders taking on giant hedge funds, as it was giant hedge funds that were long first to the point where they owned more stock than was outstanding using margin by buying shares from shorts. It was nuts.

They are the ones that made the killing.

There will be some new traders, though, that heard about silver this week and realize now that plays like Gamestop are bad and may start to think about silver as an investment. That is where some good can come out of this debacle and THAT is what silver is good for.

Soft commodities went up again yesterday and so did many energy stocks. I mentioned two stocks in this post yesterday morning.

Also I did a post on Wednesday on what I think is actually the most important trend happening in all of the financial markets now. It could be one of my most important articles of the year so if you missed it make sure you go here to read it.

There is no crying in the stock market.

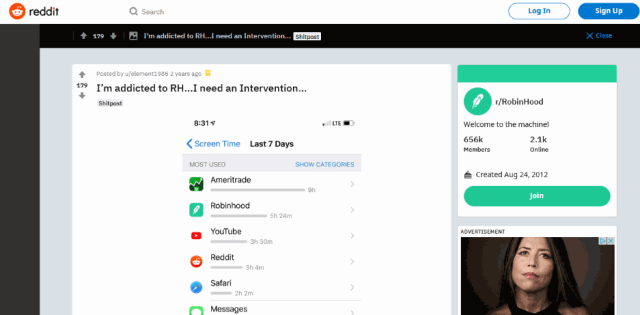

As for the idea that the little guys are victims of funds like Permit Capital – well it is their fault for trying to gamble in the stock market like this. If they want to make money they have to take what they are doing seriously. They need to do research and buy into real companies with real potential. They need to have a trading method. Using the Robinhood app as one’s main trading mechanism is like taking a knife to a gunfight. A few will learn from this experience to become winners. Most will wallow in a new victim narrative and the only way to get a few to stop is try to shake them up, even be mean for a moment at them to do it. I hope this message reaches just ONE of these Robinhood players and makes them think. Otherwise they will just take on another stupid bet on Robinhood like a gambling addict and end up like this person on Reddit.

The internet phone is destroying people’s lives. Reddit is the ultimate hellhole, the type of place John Milton wrote about.

To me the story was of little importance for the overall market (even for silver). What was most fascinating to me is how everyone last week had to have an opinion on Gamestop everywhere on the internet as it dominated the news cycle as a viral story.

a normal person explains what’s happening on the stock market: pic.twitter.com/zKKvULCirX

— Avalon Penrose (@avalonpenrose) January 27, 2021

-Mike