There is a Robinhood darling that looks ready to move. Before we get to that, though, we need to note that yesterday morning gold tumbled over 30 points right off the open to fall down towards $1,800. It barely bounced off that level going into the close. Much of this selling has been driven by sell stops as the GDX gold stock ETF closed below it’s 200-day moving average on Monday.

Gold and silver remain firmly above these levels and the reality is this is not a new decline suddenly happening on a news event, but part of a consolidation/correction that has been playing out since early August.

One odd thing about it is that while gold and silver fell hard on Tuesday almost all other commodities went up and the US dollar remained weak. Not only that, but commodity stocks outside gold and silver went up too. For instance RIO and BHP had big days.

I own both RIO and BHP. Another commodity stock I own is MOS, which soared on Tuesday.

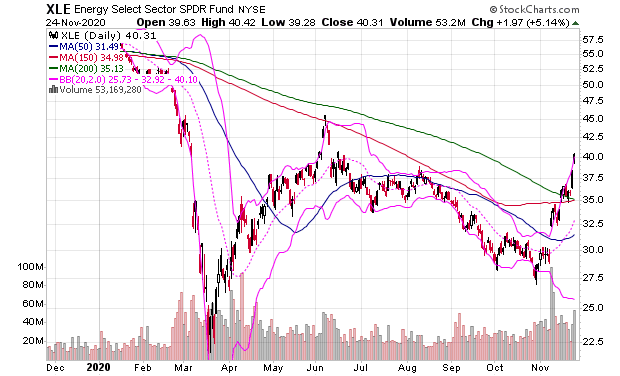

LYB also soared yesterday. I own it and mentioned it in a post last week. Also, as you can see the XLE, the energy stock ETF, also did well, gaining over 5% yesterday.

There are a lot of theories being given on the internet about why gold has dropped this week, but I really can’t link it to some sudden development, because these other commodity stocks are not falling with it this week.

That tells me that it is simply the panic ending of the correction and perhaps even seasonality that is more at work than anything else for gold now as it tends to have its worst month of the year in November and best two months in December and January.

With gold itself at long-term support I do not think this is time to sell. Often in a decline like this you’ll get a day in which you see a gap down and then rally into the close to mark a key reversal bottom. And if that doesn’t happen then you’ll just get a few days of trading around support with little movement and then a turn up that generates a buy signal on the daily stochastics.

So if you are looking for a bottom buy point watch the next few days for either one of these two things to happen.

Meanwhile, historically when it comes to seasonal trends this is the one day of the year more than any other in which the stock market almost always goes up. This is actually true for this week too. Out of all the weeks of the year this is the one in which it tends be an up week.

Next week, though, the first week of December usually leads to a dip or a pause in the stock market, so I wouldn’t be shocked if that happens.

One stock that I would never invest in, but could have a big move soon is NCLH. This cruise line is in trouble, but has a 20% short position so is vulnerable to a squeeze with this chart pattern.

NCLH has resistance in the $22.55 area and closed right on it yesterday. It remains on the top 100 most owned list of Robinhood traders, so if it moves many of them will pile on more. But, will they get out before it peaks out again?

A better stock to buy in my view, and one that I do own, is Inca One Gold (OTCMKTS: INCAF), which trades as IO on the Canadian stock exchange.

Inca One is a small cap gold producer, deeply oversold now with its daily stochastics under 20. The best time to buy in a sector is when it corrects and dips to provide an entry point and I’m expecting the seasonal bullish trend for gold to kick in.

For more in depth on Inca One Gold check out my top stock pick of the month profile I wrote on it in August you can find here.

Have a good Thanksgiving!

Take tomorrow off!

That’s what I’m going to do.

-Mike

Disclosure: Mike Swanson owns shares of Inca One Mining. Because it is a small cap stock with a market cap of less than $100 million he has put himself in a trading blackout on the stock and will not buy or sell a share of it for at least 30-days from the date of this post. Wallstreetwindow.com, is owned by Timingwallstreet, Inc., which is in talks to do a paid display marketing awareness campaign for Inca One in December. This compensation should be viewed as a major conflict with our ability to be unbiased, more specifically: This communication is for entertainment purposes only. Never invest purely based on our communication. For more on trading risks read our policy statement by clicking here.