Apple and Amazon are down in pre-market action selling their earnings reports. This earnings season has not helped stocks go up, although this morning the price of gold is up. There is a lot of nervousness about the election and we have seen all the markets trade a bit weak going into it and I personally am not looking to make any big trades in front of it. However, I’m getting emails from people who are more than just worried, because they are seeing talk of a total crash.

I’m big into gold, silver, and mining stocks and they have been in a consolidation now since the end of July. Such periods also cause a lot of worries among traders, but my favorite indicator is signalling that this is a normal correction or consolidation phase playing out and not some epic top or prelude to a crash.

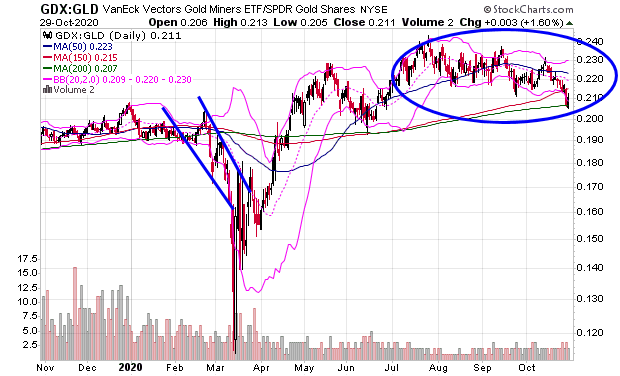

That indicator is the GDX/GLD ratio. It’s a relative strength ratio that compares the performance of the GDX mining stock index with the GLD gold ETF. When it goes up it means that mining stocks are outperforming gold.

When both are making a major top this indicator tends to go down hard before gold does. And when gold and mining stocks are in a consolidation it tends to go sideways – which is exactly what it is doing now as you can see from this chart.

In a consolidation the thing to do is to buy more on dips if you do not have a big enough position. Some try to jump in and out of big positions, but that is very hard to do and frankly I think it’s unpredictable what will happen in the next few days. There also is a danger that if you have a big position and sell it all that things will just go up without you.

In fact several mining stocks in fact went up big yesterday and a few had great news. For instance Emgold Mining (TSXV: EMR) went up 26.32%. It also trades on the US OTC as EGMCF.

I first mentioned Emgold Mining back in September and still own it. The stock has a market cap of around $11 million USD, making it extremely cheap still. I also own big cap mining company Agnico-Eagle Mines (NYSEARCA: AEM) and it went up 3.32% after reporting earnings that included a nice dividend boost.

AEM may have put in a bottom right here. It boosted its dividend by 75% to 35 cents a share per quarter. It’s a sweet reward for shareholders. Unlike most sectors in the economy gold and silver mining companies are not in a recession, but the opposite. AEM announced that “in the first nine months of 2020, the Company reported net income of $306.4 million, or $1.27 per share. This compares with the first nine months of 2019, when net income was $141.5 million, or $0.60 per share.” The company mined almost 500,000 ounces of gold in the third quarter.

As for the overall markets I think we just need to get the election ahead of us and then there will be an event that traders can look forward to buying ahead of. I talked about that yesterday in a post, but the big rally in Emgold Thursday also makes me very optimistic about my stock pick for this month too in a great silver play.

-Mike

Disclosure: Mike Swanson owns shares of Emgold Mining. Because it is a small cap stock with a market cap of less than $100 million he has put himself on a trading blackout on the stock and will not buy or sell a share of it for at least 30-days from the date of this post. Wallstreetwindow.com, is owned by Timingwallstreet, Inc., which was compensated by a third party (Leadgopher LLC DBA Pinnacle Ad Network) to conduct an investor awareness advertising and marketing campaign for Emgold Mining. This third party paid Timingwallstreet Inc., $12,000 to produce and disseminate this and other similar articles and send traffic to them through paid advertising online campaigns for 30 days beginning September 1, 2020. This compensation should be viewed as a major conflict with our ability to be unbiased, more specifically: This communication is for entertainment purposes only. Never invest purely based on our communication. For more on trading risks read our policy statement by clicking here.