Yesterday we saw a brutal drop in the DOW as it fell over 800 points and the Nasdaq closed below its 200-day moving average.

In mid-afternoon there was a buy attempt on the 50-day moving average for the DOW, but it failed and when it did the computer trading robots turned off.

These key technical levels of the 50-day and 200-day moving averages on the indices bring in robot buying, but when they bust the robots turn off and you get a vacuum in the market that causes big one day drops.

This is what happened in February and is what happened yesterday.

Meanwhile bottoms come in the market when people panic and you get a selling washout.

So can we get a real bottom today?

First, let’s look at the S&P 500.

The green line on this chart is the 200-day moving average for the S&P 500. As you can see it acted as a bottom in February, April, and May as this indicator tends to act as support in bull markets.

This morning the S&P 500 is poised to gap below this level.

After the open within an hour there will be people who try to buy the down open as a potential bottom. Robots will come in too.

If that buying can drive the S&P 500 above the 200-day moving average into the close then we will get a bounce off of this indicator.

It will be a robot bounce. And it will likely last for a week or two, but if the market goes up that way after what happened yesterday it is very unlikely to be a real bottom and only will bring with it a bigger drop later – one that could be a nightmare.

The biggest danger to the stock market now is a fake bottom.

One reason why a rally that came with no fear would be fake is that the internals of the market simply took a brutal hit yesterday.

Here are the percentage of stocks above their 200-day moving average that trade on the NYSE. As you can see it took a big dive.

Stock market corrections of 10% are normal and the market isn’t even a few percentage points off of its highs and yet the internals have gone into collapse.

The market is now facing headwinds of a slowing global economy being driven by blow-ups in emerging markets. Just this week the stock market of Egypt crashed ten percent before the US market opened on Wednesday. The US market is also facing a more hawkish Federal Reserve that said a week ago that it plans to raise rates up to three times next year. The US stock market, which is already at crazy valuation levels, is driven by cheap money and stock buy backs, which in time will be threatened by higher rates.

But the market can put in a real bottom.

To do that the S&P 500 needs to dump enough to scare people enough to cause the VIX to surge at least above 30.

So ironically a big day of selling like yesterday can bring in a real bottom or bring one tomorrow, while a robot bounce off the moving averages may bounce the market this month, but will bring more selling later when it fails.

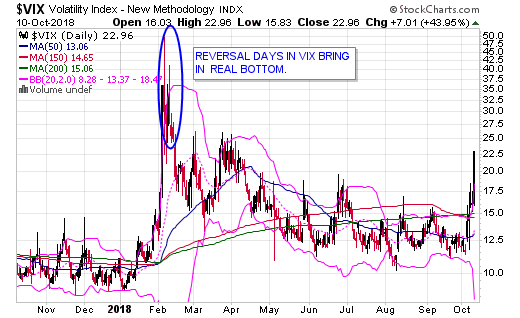

Now the VIX can be used to spot real bottoms in the market.

It does that not just by going up 20% or more in a day, but by going up above 30 and having a day in which it goes up over 20% and then has a key reversal day by closing red or even.

Remember the VIX measures the premium that traders pay in the options market for volatility. It spikes up when people go into a total panic to buy put options to hedge their positions.

We are in a key moment in the financial markets – one that brings opportunities. This is probably the last key trading moment of the year.

A panic bottom will bring us a great buy point, while a dead cat bounce here will bring a short selling entry point.

Instead of hoping one thing or another will happen for us – let’s take what the market does and take advantage of it.

And also remember out of this wreckage the top sector will come out and surge. And so far this week that has been gold and gold stocks.

There are five stocks I’m worried about in the Nasdaq though that I believe are doomed.

To get the report I just did on them click here: five doomed stocks.