I just posted an interview I did with Jim Goddard of Howestreet.com about the markets and gold stocks. I talked about what has really hurt the commodity market in the past few weeks. You can listen to this interview here:

Mike Swanson Interview: Has Gold Bottomed? – Howestreet.com Radio (08/23/2018)

But before you listen to it take a look at a few charts, because I actually am getting a few emails about buying here.

Is this a good buy point?

That’s the question.

Sometimes it’s best just to take a pause and look at the obvious to answer such questions.

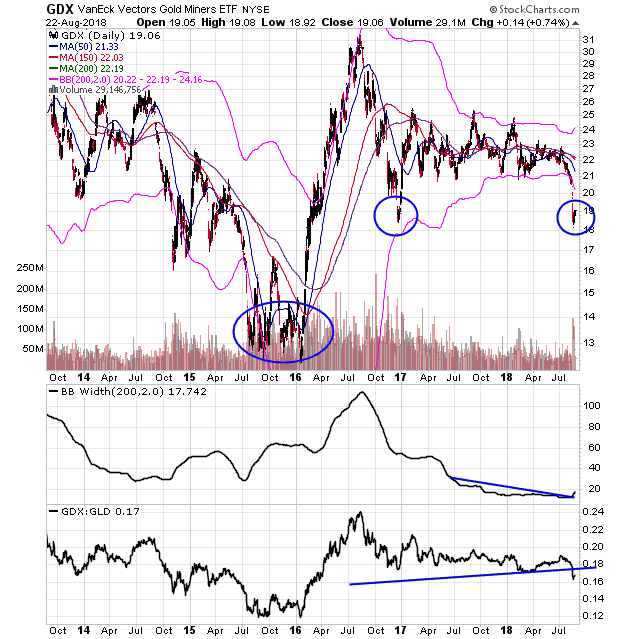

First here is the GDX gold stock ETF with the 200-day Bollinger Bands.

Obviously the GDX traded in an extremely narrow range for well over a year with support at $21. That range even got more narrow this summer to cause the width indicator for the 200-day Bollinger BAnds to go below 20 and stay below it for longer than it has since before 1972.

When a market goes sideways in such a tight range for that long when it finally goes through that range a big move typically begins and I had been expecting gold to break to the upside through resistance to begin a new rally.

Instead last week it broke down by not only closing below the the $21 level, but also by closing below the lower 200-day Bollinger Band.

That’s very troubling and would suggest lower prices are coming over the next few weeks and perhaps even months.

I wish I didn’t have to say that, because that is not what I thought was going to happen and I want gold to go up, but that is what happened and I have to report to you what the charts are doing.

Now $18.00 was also the low of December 2016, which is when gold made its last major bottom.

So there is an obvious trade here and that is buy gold stocks, because the GDX is right on that major low. You could buy GDX right now and just put a stop loss under $18.00 to play a bottom or at least a nice rally back up into the summer trading range.

That trade only works though if this is a major bottom in gold and mining stocks like we saw in December of 2016 and in the bottoming formation that was formed from July 2015 to January 2016.

If this recent low holds then this can be a major bottom like those past two and that’s why I put three blue circles on the chart.

It’s seems so simple – and so obvious.

However, I got to tell you that right now I don’t see any indication that this is a real bottom.

One problem is that those last two real bottoms came in with the GDX above or right on its lower 200-day Bollinger Band and now it’s trading below it. If gold were to bounce more here the recent $1220 support level is now going to act as resistance and so will the $21 area on the GDX. It would probably at least retest the recent lows.

What bothers me now though is that typically when you see a drop in gold and gold stocks it ends with the gold stocks performing better than the metal.

You can have a washout day in which gold is down $20 or $30 and the GDX is barely red or even in the green at the end of a drop.

That’s the type of action you get on a bottom and it hasn’t happened yet.

In fact the GDX/GLD relative strength indicator has simply gone sideways since last week’s drop. It’s easier to see this on an hourly chart than a daily chart.

As you can see this GDX/GLD ratio is simply going sideways right now.

I want to be buying on a bottom, but I don’t want to tell you to buy on a bottom unless I really believe we are seeing one.

And right now I just can’t say that.

Maybe things will look better on a successful retest, but here is what I need to see in order to identify a bottom.

I would need to see some more basing take place that would probably bring with it a move down to the $18 support level on the GDX for a successful retest while gold drops to briefly break it’s recent low. Such action would setup the type of positive divergence in the GDX/GLD ratio to give us a bottom signal.

But we have no bottom signal now and this bounce could easily end with another leg down.

So I think caution is the rule of the day here until we can see signs of a good bottom being put in either over the next few weeks or even the next few months. Yes I’m watching for a possibly successful retest for a buy signal, but am prepared in case this bounce fails too for a bottom later in the Fall.

Gold is not the only thing that has taken a surprising hit in the past few weeks. I believe there are some things in the global economy that have been happening to cause the gold drop and drop in commodities in general that will in time lead to an even bigger run than people had been planning for. It’s just taking yet another bump in the road to get to it.

I explained these economic factors with Jim Goddard in yesterday’s interview. To listen go here:

Mike Swanson Interview: Has Gold Bottomed? – Howestreet.com Radio (08/23/2018)