There are many stocks and sectors in the financial markets that are considered to be defensive investment plays, but gun companies are in a special category.

There are many stocks and sectors in the financial markets that are considered to be defensive investment plays, but gun companies are in a special category.

People who invest in companies that produce guns and ammo are often betting that an extreme shock in the USA can lead to higher sales for both.

Historically when a new Democrat gets elected into the White House there has been a short-term burst in gun sales as gun owners and members of the NRA fear that such a person will begin stricter gun laws that will ban certain types of weapons and ammunition. Those sales help gun companies make more money, which can help make their stock prices go up.

And in the past few years we have seen short-term spikes in gun sales following tragic mass shootings like the one that happened at Sandy Hook and in Orlando this year. The Sandy Hook shooting in 2012 resulted in the terrible shooting of twenty children, but created an immediate boom in gun sales as people feared tougher gun ownership laws would appear.

Today there also is a sense of fear and dread in the air in the United States that is becoming noticeable with a spreading social meme of fear and bursts of mass panics occurring in the country in the past few months.

We have seen this in talk of crazy clowns and a few panic freak outs in shopping malls that have happened when people stampeded out of the mall in fear of a shooting incident that turned out to be a false alarm. People are on edge and on trigger.

There are many people getting into prepping for some future catastrophe, whether it be a terrorist attack or a simple stock market bear market financial drop that brings more hardships and rioting. The reality is that today’s world rests on an empire of debt and everyone knows it.

The simple bet many are making to protect themselves from future financial shock events is to simply invest in gold. Silver and gold are going up anyway as the precious metals market began a new bull market in the first quarter of this year, even though it has had a pullback in the past few months. I myself really believe that the best stocks to buy now are gold stocks.

In this environment you might be wondering if you should invest in gun companies though.

The biggest gun company you can buy on the stock market is Smith and Wesson so let’s take a look at its stock chart.

As you can see shares of Smith and Wesson, which trade under the symbol SWHC have risen over the past few years.

People love to buy stocks the more they go up, but you really need a strategy to be able to buy and sell stocks.

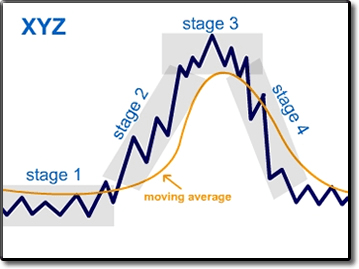

I use simple technical analysis and stage analysis to make those decisions.

When I do that it is clear to me that SWHC is in some sort of stage three topping process. Now it has come down to its 200-day moving average, which often does act as a good buy point when a stock is in a big bull market, but when that stops working then you know the trend has become more negative.

This has not happened yet, however from the stand point of using relative strength investing strategies there are danger signs.

Relative strength means looking for stocks that are going up more than the market is going up and fall less when the market does.

This can change and when a stock is performing better than the market averages then it is time to own it. SWHC did this in 2015.

But when a stock starts to lag the market by going down faster than the market does and then having weak rallies it can become dangerous to continue to hold the stock.

These things do change from time to time, but as of August SWHC started to do just that.

So this is a different time. Most of the time you want to buy SWHC and other gun stocks into the election of a new Democratic President, and with Hillary Clinton leading the polls that seems likely to happen again, but this time the relative strength performance of SWHC compared to the S&P 500 and Nasdaq is not doing well.

So this is a time to watch SWHC for now and not be a big buyer in it at this moment in my opinion based on this warning sign.

If you are new to this website then get on my free email update list for more information and future actionable ideas. To do that just scroll below.