|

Your Game Plan For Trading Gold

Click Here: Grab The Total Gold Trading Program

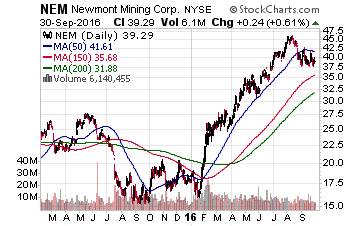

Yes gold stocks and gold are lined up for a good entry point trade now that should lead to big gains in the coming months and even years. And this goes for silver too. For the past few weeks now I have been talking about this entry point in my videos, blog posts, and interviews you may have heard me do elsewhere. So you should know that now is the time to act. That's the trading perspective and it's important and fun, but there are three other reasons you need to get involved in mining stocks and gold investing. I know the action in the US stock market dominates the minds of almost all American investors right now after the Trump election last year and the breakthrough of DOW 20,000 and now the runs in stocks like Amazon and Facebook and Nivdia because that is all they talk about on CNBC right now, but to do big things in the markets you cannot just buy and sell what everyone else is doing. It's fun to be in the market when it is going up. But it is even more fun to BEAT the markets! And to do that you need to get into the right things. You must avoid risky ETF's and toxic situations like JNUG and DUST unless you want to become a minute trading daytrader, because these things both decay overtime. That's not me, I look to buy and invest in positions I expect to go up for months on end if not for years. GOLD IS A NECESSARY PLAY TO BEAT THE MARKET NOW The thing is big things have been happening in gold and mining stocks for the past year that most people are still ignoring. In 2016 gold stocks were the top performing sector in the entire stock market. In fact the GDX gold stock ETF went up 52% in 2016. In comparison Apple went up 7.9% and Facebook gained 9.9% in 2016. To beat the market you need to be in the best sectors in the stock market. The reason why gold stocks went up so much is because they started a new bull market in 2016. Right now gold stocks are pausing and CNBC and the financial press in general has a tendency to only focus on what stocks are going up the most in any single day. That leads people to chase hype and not get in the best things on good entry points. Now is the time to pay attention to mining stocks and move money. Investors in gold stocks have been beating the market averages since the start of 2016 and even a position of just 20% of one's money in them to start that year out would have enabled one to beat just about every single hedge fund manager on the planet last year. Even with the DOW rally. But if you are not in gold stocks yet don't worry, because it is not too late. Yes, you can seize the day. I use TC2000 to track the stock market and the sectors in the market. They say a bull market always starts in something new every year and in 2016 it was in mining stocks that a new bull market started. That is one reason why they went up so much. In my view buying gold stocks now is like buying the DOW back in the summer of 2009. Just look at the charts. This is how they looked in September on their first big bull rally.

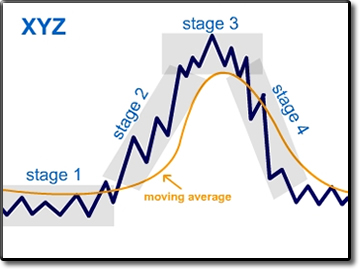

But after that first beg bull leg gold and mining stocks pulled back. That's typical in a new bull market, because you usually see big gains off of the bottom and then a pause phase that can last from three to twelve months. If you can remember what the US stock market did in 2009 the S&P 500 rallied like mad off of its March low that year and then paused in the summer. Then it broke out to go up for years. That summer pause made for a nice entry point and I believe the current consolidation pause in gold stocks is doing the same thing. All financial markets move in cycles and gold simply started a new bull cycle last year. It is the simple and the obvious that leads to big investing gains when you act on it.

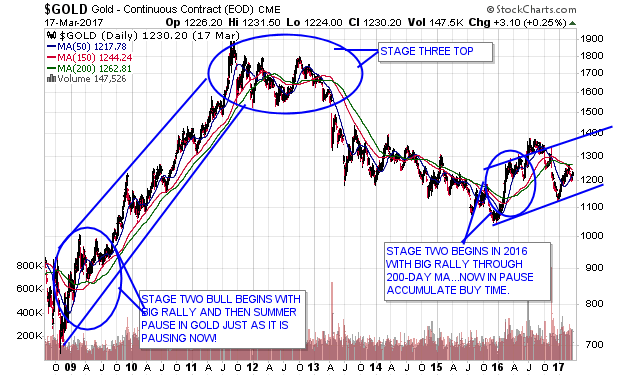

There are really four stages to any given market cycle. Gold had been a terrible stage four bear market that ended last year and began way back in 2011. It then went through a stage one basing phase that completed in the first few months of 2016. The stage two bull phase started when gold broke though it's long term 200-day moving average in February of that year as you can see below.

Now I'm not going into huge details right now about stage analysis as I wrote a book best selling book in 2010 on that topic called Strategic Stock Trading if you want to go in depth about it. What is important for you to know today is that most stage two bull markets last from three to five years, but with all of the financial problems in the world and currency woes this one is likely to become one for the record books when it comes to gold much like the 1970's bull market was. This is why so many people think that gold is going to reach the $10,000 per ounce price in a few years. The thing is it doesn't even have to go up that much for gold stocks to go up more than anyone can imagine from where they are now. The funny thing is that a lot of people buying gold today based on predictions of $10,000 an ounce of gold imagine that they are going to get rich one day. In reality big gains are being made right now by people that are in the right mining stocks, because mining stocks are going up faster than gold is! There are junior mining stocks doing better than even the GDX is. And the thing is making money in the financial markets is not about predicting the future. It's about understanding what is happening now that others do not understand and acting on it! It's not about dreaming about tomorrow but seizing the day today! You see the important thing for you to do is not to put your trust in predictions about the future, but to know why the current price of gold is making the stocks go up so much already. No one can predict the future and smart investing is not about predicting the future anyway. Let me explain. Gold stocks go up more than gold does. The Real Reason Why Gold Stocks Go Up So Much There are gold mines all over the world and last year it cost on average $1,200 for these mines to generate a single ounce of gold. The price of gold though was falling for years and even fell below $1,200 an ounce in 2014 and stayed below it for months in 2015. Bear markets can bring extreme selling and that is what happened. Yes there are many efficient mines that do produce below $1,200 but what happened is that many mines had to shut down and so a lot of production came off the market. The bear market also caused investor interest to fade when it came to putting money into mining deals. So many small mining companies went under. Only now are some of these once dormant mines coming back online and this year investor demand for gold is outstripping production. A major secular low in the industry simply occurred in 2015. So one reason that mining stocks are going up so much now is that they are recovering from depressed levels. That's why in the first year of a bull market you can see stocks go up for months on end without pulling back. That's what the S&P 500 did in 2009 for instance. It is no shock that one of the worst bear markets in mining stocks ever is generating one of their greatest rallies ever. And it is not over, but there is something key about gold stocks that few understand that you need to know. THE GOLD PRICE MONEY MULTIPLIER EFFECT

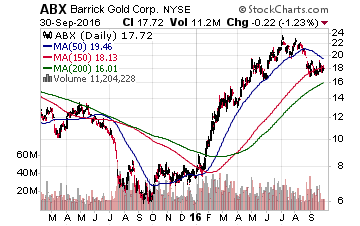

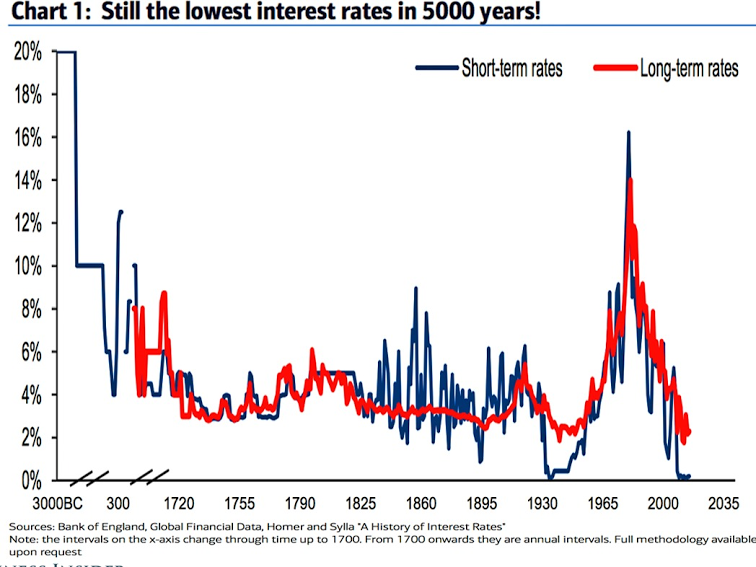

Everyone knows that the stocks that go up the best in the stock market are stocks of companies that are rapidly growing their earnings and bottom line. What few understand though is that with mining stocks a one dollar rise in the price of the price of gold has an exponential impact on the earnings of mining companies. There is a money multiplier effect for earnings growth that benefits shareholders. Let me explain. Imagine there is a mining company whose cost of production is $1,200 an ounce and gold is trading at $1,250. That means the mining company is making $50 per ounce of gold. Now let's say the price off gold goes to $1,300 an ounce for a 4% increase. Well the mining company is now making $100 per ounce of gold instead of $50. So you see how a 4% increase in gold prices can mean 100% earnings growth for a mining stock. This is why mining stocks are going up so much this year and are simply going to go up and up more than people are thinking. Wall Street analysts have yet to upgrade their earnings estimates for mining companies properly. Buy upgrades will come. As I write this 15 Wall Street analysts are covering NEM and all of them have price targets lower than its currently trading price and none have a strong buy on the stock. The same is true with ABX. The 22 analysts that cover it have an average price target of just $18.71 for it, which is below its recent closing price of $23.16. They are going to have to upgrade these stocks and put higher price targets on them or they will look silly. That will cause mutual fund managers to chase. Think about this question - how many people do you know personally that own mining stocks? I'm sure some of those people will end up being buyers of miners someday. But it is always the early bird that gets the worm. Grab it! Of course the best mining stocks will go up the most and go up faster than the popular gold ETF's are doing and even more than big caps like NEM and ABX do too. This why I have been buying individual mining stocks this year and almost every single month and am going to buy more and more of them. And I think you need to take advantage of this. GOLD WILL BECOME A NECESSARY INVESTMENT There is a second reason that you need to get involved in gold. Even though the masses are asleep on gold one day everyone is going to begin to view it as a necessary investment. Most American investors have been trained to believe that safe investing means putting half of your money into the US stock market and half of your money into bonds. The idea is that bonds are safety. And historically bonds will actually go up when stocks fall as people take money out of "risky" stocks and move it into "safe" bonds. Since about 1980 when stocks have fallen bonds have gone up. So this investment strategy has worked for the past few decades. But there have been times in history in which bonds and stocks go down AT THE SAME TIME. That happened for years during the 1970's. People are not ready for this. We saw manic valuations in the global bond markets that have all of the makings of a secular top when negative rates were reached on government bonds in Europe. In fact what we saw was the lowest bond yield's in world financial history. Take a look at this crazy chart and you'll see what I mean:

Negative rates last year meant interest rates had nowhere to go up, but up! And they have been going up a little ever since. This is important for two reasons. When rates go up the value of bonds go down. That means in the future there is a high risk that we are going to have a bear market in stocks and bonds at the same time. That will smash people who think they are investing "safely" by having all of their money in both. As time goes on more and more people will come to see that they need to put some money into something else that does not trade with stocks and bonds. And that of course is gold, which historically has a low correlation to what the stock market is doing. And that is why gold is going to become a necessary investment for people. Gold can go up anyway without big trouble blowing in the financial system. It did from 2000 till 2008 and did again from 2009 till 2011. And gold stocks soared last year. But if in a few years bonds fall into a bear market it will just be another reason for this new gold bull market to become a giant one. And it just makes perfect sense from a diversification stand point to get involved now in the metals and mining stocks. THIS IS THE ENTRY POINT Now consider the third and perhaps most important reason you should get involved with gold and silver and the mining stocks today. Sadly most people chase things AFTER they have gone up a lot. That's why the masses are not in gold yet despite the big gains in gold stocks last year. It just needs to go up more before they will get excited. Really when gold is around $1,200 an ounce CNBC stops talking about it and people lose interest. When it gets above $1,300 an ounce though some people start to chase and buy. And a move from $1,200 to $1,300 an ounce for gold means 50% moves in many mining stocks. As I have been showing you in my updates I simply think now is the time to take an entry point in precious metals and mining stocks. And so now is the time for you to get involved by grabbing my Total Gold Trading Program today. Right now the GDX/GLD ratio has a simple triangle consolidation pattern that it is poised to breakout of. I think it can do it this week and once it is done this entry point will be gone. And that is why today on DATE I opened up my Total Gold Trading Program for new members. You see I try to time my offers to when there is something worth doing now in the financial markets, because people want results and I want you to get into my service at the right time before the golden train leaves the station. I am not interested in telling you to chase something that has already gone up for months on end, but instead getting you started at a lower level with a good entry point. TEST DRIVE MY POWER INVESTOR STOCK PICKS While I put out a lot of free content in videos and emails my best information is always reserved for my private Power Investor members. This is my inner circle of people. They get all of my stock picks and always find out about them on the ground floor way before the general public does. Every week I send Power Investor members a comprehensive PDF file going over what I see what is happening in the financial markets and my new trading ideas whether they be in ETF's or in individual stocks. They find out what stocks I own and what I'm doing in my main portfolio. You need to buy these stocks and get into my next new mining stock pick. The last stock pick I mentioned in my free email list in a blog post was IDM Mining (I still have a position in it with 140,000 shares and 70,000 warrants). It was trading 17 cents at the time. I actually bought it in a private placement offering in April of 2016 for 9 cents a share. I told Power Investor members about the deal and I have no doubt some got in the offering. Others I am sure just bought it normally in their brokerage accounts around that price before it went over 17 cents (private placements can be complicated for people and you are locked into a four month holding period where you cannot sell the shares and many people do not want that restriction so they just buy the shares normally in their brokerage account). But here is what happened. It became a money multiplier. And it looks like it is getting ready to go up again. I only talked about it in the free newsletter after it went up for Power Investors, because they get in on the ground floor. And this is only one stock we are involved in. There are others and there are going to be more. And there is no better way to maximize your potential return on the gold bull market than to get involved in this yourself. Yes there are risks in stocks as there is in all investing, but you can see that mining stocks are now in a sweet spot. Today you can get a free 30-day risk free trial to my Power Investor Service as a bonus to my Total Gold Trading Program. Most people force you to pay a big up front fee sometimes for thousands of dollars to get into a group like this, but I believe I have the most valuable investment group on the planet and feel confident that you will agree once you see for yourself. So the 30-day trial is simply included as a bonus to my Total Gold Trading Program. It's my total package for gold investors with everything I got that you need. After 30-days the Power Investor membership will renew for $97.00 a month. So if you decide it's not for you all you have to do is cancel before the trial period is up and you won't be charged for it. To get the trial you just gotta grab my Total Gold Trading Program package. The first thing you'll get is my Gold Trader's Toolkit. Introducing: THE GOLD TRADER'S TOOLKIT

The Gold Trader's Toolkit video course is perfect for beginners or seasoned traders alike who want to get involved and master the gold markets. One thing in it you will learn is how private placements work and what you need to do in order to get in them. Private placements typically allow you to buy shares of a mining stock with a warrant attached to them and sometimes they allow you to buy shares at a discount to their exchange trading price. These modules will show you how to get into insider gold mining deals, how to pick the best mining stocks, how to construct your own gold trading system via ETF's, and how to use our model rebalancing portfolio system involving one simple trade a week in gold. This system is not a black box system or one using complicated indicators, but one based on a simple mathematical principle. Once you The Total Gold Trading Program you will get instant access to these videos and accompanying PDF materials. Here are the modules you will get:

BONUS: STOCK MARKET SECTOR ROTATION STRATEGIES (VIDEO + TRANSCRIPT) You are starting to get an idea of the power of mining stocks, but there is more. Along with the six modules in the Gold Trader's Toolkit if you get the bonus Total Gold Trading Program you also will a new mini-course I developed in January as a one time offer. I sold it right after New Years and then put it up for sale on Amazon.com as a DVD for $47.00. This course is about how to identify the best sectors in the market to invest in and WHEN to enter them using this specific entry point strategy. It's not about chasing like you see on CNBC where they tell you to buy whatever is up the most in any given trading day, but to analyze how sectors are moving against the market at the right time. What this bonus contains is a simple 60 minute online video and PDF transcript. And I actually plan on releasing this mini-course again as a stand alone course sometime in the coming months, but right now you can get it as a bonus to the Total Gold Trading Program! BONUS: My Top 15 Big Cap Mining Stocks To Buy And you will also get a huge bonus that can reduce the management fees you may be paying in your account with mining stocks and boost your dividend payments. If you own the GDX ETF you are paying a 0.52% annual management fee and getting a 0.24% dividend that pays only once a year. The 2X and 3X ETF's that are so popular typically pay no dividend and have management fees over 1% in them and DECAY to act destroy portfolios. In the long-run these 3X ETF's drain your account out if you are looking to invest in this sector and hold for a few years. Well you can escape those fees and decay problems and get bigger dividend payments by buying these 15 big cap mining stocks that are in the GDX and NUGT ETF's anyway! All together these 15 stocks will pay you a 1.49% dividend. If you were to put $100,000 into GDX and bought these stocks instead you can make make over $2,000 more a year! This report is essentially my top 15 big cap mining stocks to buy and you will get it as another bonus today. And I personally own all of these stocks. THE POWER INVESTOR TRIAL Let me explain more about what you will get in the Power Investor Trial. It will give you access to my model portfolio which invests in a mix of exchange traded funds to invest in simple positions in order to take advantage of the changing trends of the markets. This portfolio typically invests in up to five exchange traded funds at a time. So this will tell you what I think are the best five ETF's to invest in. For more short-term trades you will also get access to my top individual stock trading, options trading, and commodity trading ideas every single week. So you will know exactly what stocks I am personally the most involved in and think are the best ones to own and even ones I like to bet against for stock market drops. I short stocks too and spend hours and hours a week looking through stocks to find the best and worst ones for you in this service. It's about finding trades that work. And yes that means my best mining stocks and even private placement ideas. What you will get as a Power Investor subscriber is a PDF research report from me every week in which I go over what is happening in the stock market, metals markets, commodities world with trading setups and any changes being made to my model portfolio revealed. Reading this PDF report every week will keep you informed about everything going on in the financial markets and give you a leg up on everyone else. The Power Investor Service renews at the price of $97.00 every 30-days. Your first 30-days are free as a trial membership. If you decide it is not for you all you have to do is cancel before the 30-day trial period is over and you will not be charged anything beyond your payment for the Total Gold Trading Program. Now you could also simply forget about the Power Investor Service and the bonuses and just get The Gold Trader's Toolkit course if you want. I would not do that myself, but if you have family members with no money to invest with yet who are simply looking to learn before they open up a brokerage account that option is available for you. If you are looking to step up to the plate and drive some mining stocks out of the park The Total Gold Trading Program is for you, because it is the only way to get into the Power Investor Service.

Important Usage: What will happen once you click the buy now button is simple. After you hit the buy button you will be taken to a page where you can fill in enter email address and credit card or paypal details. This will be verified instantly and you will be sent an email with access information. You can reach us at our support desk by clicking here.

ClickBank is the retailer of products on this site. CLICKBANK® is a registered trademark

of Click Sales, Inc., a Delaware corporation located at 917 S. Lusk Street, Suite 200,

Boise Idaho, 83706, USA and used by permission. ClickBank's role as retailer does not

constitute an endorsement, approval or review of these products or any claim, statement or

opinion used in promotion of these products. Clickbank "will, at its option, replace or repair any defective

product within 60 days from the date of purchase. After 60 days

all sales are final." This means that if you are not happy with

your purchase of the POS Stocks Program that you can contact them and

tell them that you want a refund in the first 60 days.

©1998-2016 Timingwallstreet, Inc. All Rights Reserved. "WallStreetWindow" is a tradermark used by Timingwallstreet, Inc. Disclaimer can be found here. Our shipping and refund policies for physical products can be found here. |

|||||||||||||||||||||||||||||||||