|

How My Gold Investing Program Works Click here: Buy the Total Gold Trading Program

About Us Technical Analysis Strategic Stock Trading Podcast Contact Us

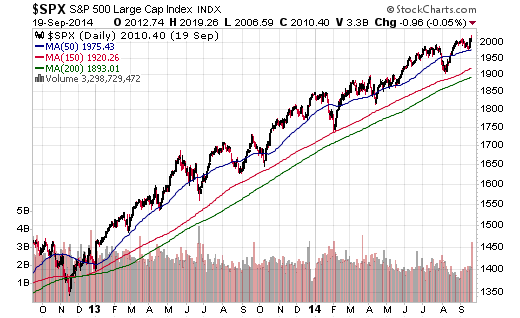

Gold is quickly becoming the necessary investment to own in a portfolio and the safest thing to trade if you use it right. I'm going to show you why. In this you will see how owning a simple gold position in your portfolio can safely boost investment returns. It's helped me smash the returns of almost every single hedge fund on the planet this year and can help you do the same. You'll also see how and why gold and mining stocks are becoming the simplest things to trade in the markets in order to make nice gains in a stock market that seems to be going nowhere. I'm going to show you a simple tested trading system that involves doing only one trade a week. Gold is important now, because it isn't only the gold gains that are starting that are making gold fun to be involved in. It is in fact stock market problems that is also making gold ownership a necessity. Hello my name is Michael Swanson. I run the website WallStreetWindow.com and have been in the stock market for years. I also run a private membership area called Power Investor for high net worth investors and institutional traders. Like you I have seen the boom of 1999 and the bust of 2008 and the wild moves of the past few months. And I have seen the Federal Reserve take action to make the stock market go up. In 2008 the Federal Reserve lowered rates to zero and in 2009 it began money printing operations called quantitative easing to force the stock market back up after it crashed. And they did this in 2010 and 2012 in order to keep it up too. In fact after they did it in 2012 the stock market went up for two years at a forty-five degree angle without ever pulling back. Look at this chart and you can see what I mean.

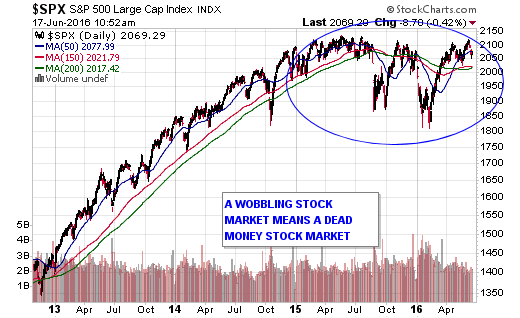

I call this move the stairway to heaven rally. The stock market had never traded like that before in it's history. It had never gone up like that for so long without a real correction before. This was the impact of Federal Reserve manipulation through its money printing. And as long as the stock market continued to go up like this people had fun, because it seemed like it was easy to make money in it. But then in 2015 the stock market stalled out and the stairway to heaven came to an end and it has not made a new high ever since. It's just wobbling.

So now all people are doing is watching the stock market make these big swings up and down as it goes nowhere leaving them feeling confused by the market. The tough reality is that very few people are making any money in the stock market anymore and most people have no idea what to do with the market to make money now. But most are not even sure that they know what is happening to the financial markets. First you need to know that there are three things that have happened to make the stock market behave like this. Financial markets move in bull and bear cycles.

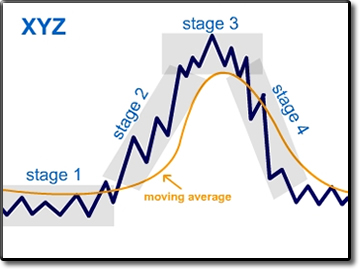

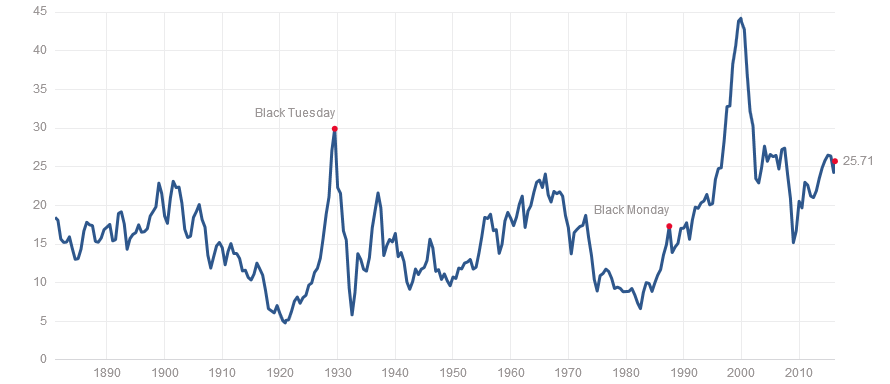

I call them stages and you can tell what type of risks you are taking for what potential return by identifying what stage in a financial market you are in. The stock market was in a stage two advance way back in 2013 and 2014 and that was a long time ago. So times have changed. But the stock market did go up so much in that big bull market run that it became overvalued from a valuation standpoint. In terms of the cyclically adjusted P/E ratio in fact it had only reached a valuation level like this three times in its prior history.

Those times were in 1929, 1999, and in 2007. The simple fact of the matter is that the more highly valued a stock or market gets the more risky it becomes. So the market is actually at risk of suffering from more stock market drops. But this situation is now happening to stock markets all over the world and you have been seeing constant central bank interventions to try to manipulate the markets and prop them up. But these moves are not all working anymore. The stock market in China has crashed, despite government action there. And in January the Japanese Central Bank announced a giant money printing operation to try to make their market go up. But all it did was pop and dump. Then just a few weeks ago the European Central Bank announced a giant money printing program of their own and the markets have done nothing over there. The problem is that such programs cannot create brand new giant bull markets at this stage of the market cycle. But they do create big moves up that last weeks and sometimes months. But the big swings up and down are confusing to most people and so in the end they do not make any money out of this, because it's hard to catch a good wave that lasts. So most people are just caught in this central bank money trap spinning their wheels not knowing what to do and taking more risks every day to make nothing. The reality is the stock market is becoming a big mess. But there is a solution to this problem that can help you generate steady returns in an uncertain world. This solution is to own gold. And today gold is easy to own and trade in any brokerage account with exchange traded funds and you can buy mining stocks that mine gold for extra juice. Now I want you to think outside of the box with me here when it comes to gold for a few moments. Most people say that gold should be owned as some sort of insurance policy in case a true debt calamity breaks out or the dollar collapses. So they try to scare you into buying gold. But gold itself can actually be used to safely boost overall long-run portfolio returns even in a traditional portfolio. Let me show you how. Take a look at this.

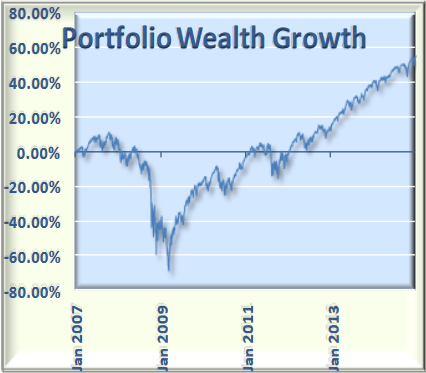

I want you to forget about this year and last year, because they have been sad for the stock market returns and I don't want you to think that I am trying to tell you that gold is great because it is up and the stock market is dead this year. I want you to see something more important in a back test. I want to show you how gold can boost portfolio returns even when the stock market does better than it does. People on CNBC were saying that gold was a bad investment for years, but they are wrong. What you are looking at above is what would have happened by the end of 2014 if you put all of your money into SPY on January 1, 2007. SPY is an exchange traded fund that tracks the S&P 500. You would have made a 55% gain. That sounds nice, but you also would have got hit in 2008 and 2009 to the tune of a 67% loss. And you would stand to lose big again if that were to happen again. Now I want to show you what real diversification does to long-term investment returns.

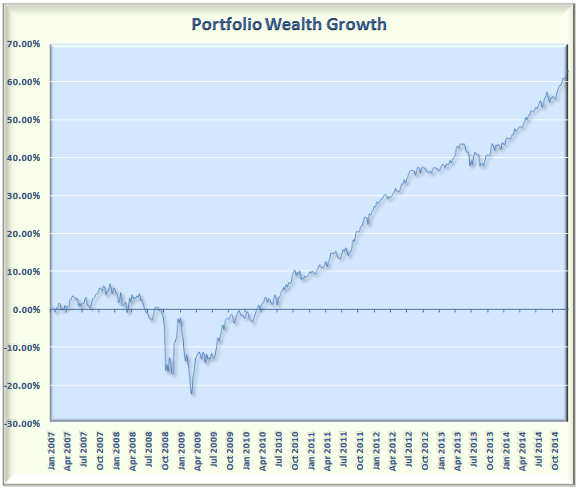

Ok this is what happens with a portfolio that is invested 50% in SPY and 50% in TLT on January 1, 2007. TLT is an ETF that owns US Treasury bonds. By the end of 2014 this portfolio would be up 63% by the end of 2014. And it would only have been down 22% during that nasty 2008 and 2009 bear market. But here is something funny. TLT only went up 34% during that time so doing this meant putting half of your money into something that did not go up as much as the stock market went up. So how could you beat the market returns like this? And by the way a 63% return during these years would have beaten just about every single hedge fund on the planet. There is a secret to this. It involves doing one single trade every week to maintain the 50% allocation in SPY and TLT. You see if you do that you lower the volatility in your portfolio and boost long-term returns. I do not have time to go into the full math and how this works in full detail in this video, but I have the resources for you to get at the end of this video to help you understand this and apply these concepts to whatever you are doing. The key though is that this simple system makes it so you do automatic buying on dips and do some selling on rallies. You see the secret to long-term success in the markets is money management and proper diversification. And then you don't sit there confused like everyone else anymore. You see this game is about making more money than most people make and losing very little money when most people lose big, because they do not know what to do. What I am showing you is called Model Portfolio Rebalancing and it is perfect to use with exchange traded funds. It also works best when you are in more than two funds and in funds that are not trading together. That way when one fund is strong another fund might be temporarily lagging a bit and then the situation changes and you are automatically taking advantage of trend changes. So look at this.

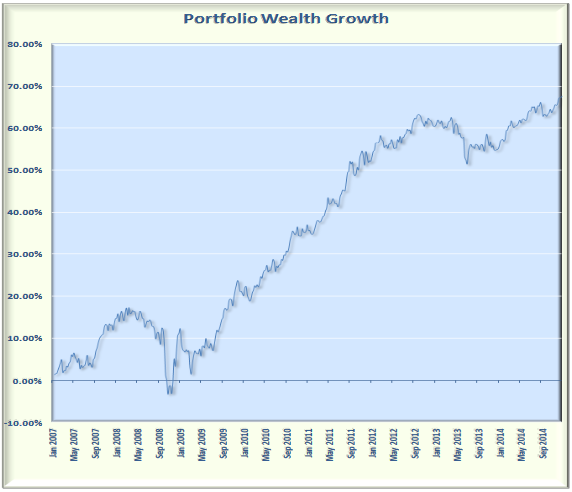

What you are now looking at is a portfolio that is invested in SPY, TLT, and GLD. The money is invested in one third each and rebalanced every week to maintain that fixed allocation. GLD is the ETF that invests in gold bullion. Now this portfolio would have gone up 70% and only lost -3.27% during the bear market of 2008 and 2009. Imagine beating the market and just about every money manager on the planet and losing just about nothing when it falls. This is the profit boost that gold can be used to power a portfolio. And yes I own gold like this today myself and it has been boosting my portfolio up this year while most people have been spinning their wheels in the stock market for months on end. There is really no reason for anyone to have all of their money in the US stock market and just hope it will go up for them at this point. We simply are not living in the bubble days of the 1990's or even seeing anything like the stairway to heaven rally of a few years ago. Just hoping that the stock market will go up again like that is not making people money anymore. The stock market has problems. But that's ok, because this model rebalancing portfolio system takes those problems away by using diversification in multiple markets and asset classes to lower risks and boost returns in the long run. And it does it by using the true power of gold investing to escape the stock market doldrums. Now this is only one of the reasons why I own gold right now and why I am doing more. You see gold has been the strongest performing asset class this year, because it is coming out of a five year plus bear market. It last peaked in 2011 and when something is in a bear market as long as gold was it makes a major bottom and then goes up huge for years. Gold is now starting a stage two bull market. I have invested in past gold bull market cycles in companies that mine for gold.

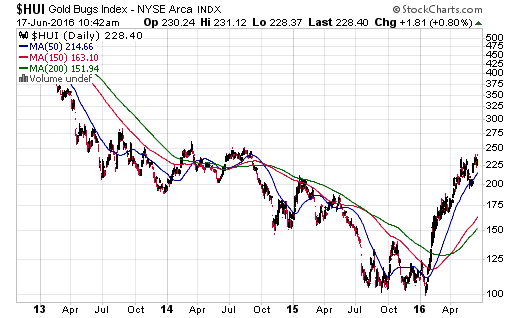

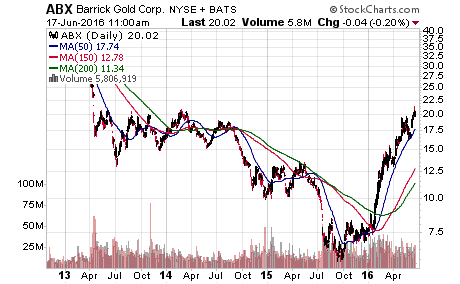

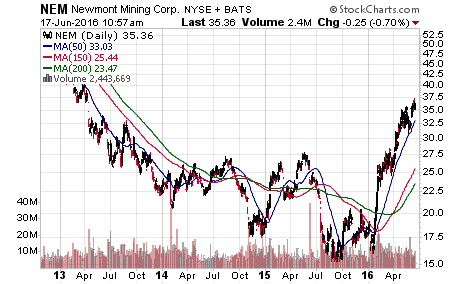

The HUI mining stock index has rallied over 100% since it made a low in January. I have bought gold and mining stocks in past bull markets and know from my own personal experience that the gains in them can be huge. So gold is now not only something that you can use to safely boost your long-term portfolio returns, but you can use it to generate absolute returns for years to come.

Gold and stocks for the companies that mine gold such as Newmont Mining and Barrick gold have simply broken away from the stock market and started to go up this year. I believe the gains for these stocks are only beginning, because I believe that this is simply a new bull cycle for them. The mining stocks are where they were in 2009 or where the stock market was in 2009 for that matter or 2012 before the stairway to heaven began. So that makes now a great time to buy mining stocks and to buy gold. And there are other ETF's besides just GLD you can use. In fact so far this year almost every single day the ultra gold ETF DUST is one of the top traded ETF's by volume every day by people jumping in and out. And so is the JNUG ultra miners ETF. And there are ways to play gold on a short-term basis too. So to help you invest in gold, mining stocks, and to even learn to trade gold I have put together for you a brand program to help you do just that. Yes, most of my products are expensive. I will not deny that, but they are expensive, because they are more than worth it. Introducing: THE GOLD TRADER'S TOOLKIT

The first thing I have done is I have created a new series of six video modules for you called The Gold Trader's Toolkit. This course is perfect for beginners or seasoned traders alike who want to get involved and master the gold markets. These modules will show you how to get into insider gold mining deals, how to pick the best mining stocks, how to construct your own gold trading system via the ultra ETF's, and how to use our model rebalancing portfolio system involving one simple trade a week in gold. This system is not a black box system or one using complicated indicators, but one based on a simple mathematical principle. Once you buy it you will get instant access to these videos and accompanying PDF materials. Here are the modules you will get:

Now you can grab this course all by itself, but I have created a huge bonus for you that will help you master the gold markets to your maximum advantage, I firmly believe that there is nothing better that you can do today than to grab this course and these bonuses. THE BONUS: THE TOTAL GOLD TRADING PROGRAM Along with the six modules in the Gold Trader's Toolkit if you get the bonus Total Gold Trading Program you also will get a complete PDF report in which I will give you my top three mining stock picks. These are mining stocks that display all of the characteristics of my "Two-Fold Formula" for picking out stocks. They have cheap valuations, huge earnings growth potential, and a stair-step consolidation breakout stock pattern. And you will get my updated gold stock investing manual for 2016. so as part of the Total Gold Trading Program you will get as a free bonus my entire PDF manual for investing in gold and mining stocks. This manual is titled The New Gold Stock Investing Essentials. If you like to read and do not want to watch videos than this guide is for you. It is totally up to date and current for the year 2016 and will not be offered for sale anywhere else. INCLUDES FREE 30-DAY POWER INVESTOR TRIAL I have also included in this Total Gold Trading Program bonus a free 30-day trial to my core product, which is my stock market advisory service that I have been running for 16 years now. It's called WallStreetWindow Power Investor. It includes access to my model portfolio which invests in a mix of exchange traded funds to invest in simple positions in order to take advantage of the changing trends of the markets. This portfolio typically invests in up to five exchange traded funds at a time. So this will tell you what I think are the best five ETF's to invest in. For more short-term trades you will also get access to my top individual stock trading, options trading, and commodity trading ideas every single week. So you will know exactly what stocks I am personally the most involved in and think are the best ones to own and even ones I like to bet against for stock market drops. I short stocks too and spend hours and hours a week looking through stocks to find the best and worst ones for you in this service. It's about finding trades that work. What you will get as a Power Investor subscriber is a PDF research report from me every week in which I go over what is happening in the stock market, metals markets, commodities world with trading setups and any changes being made to my model portfolio revealed. Reading this PDF report every week will keep you informed about everything going on in the financial markets and give you a leg up on everyone else. The Power Investor Service renews at the price of $97.00 every 30-days. Your first 30-days are free as a trial membership. If you decide it is not for you all you have to do is cancel before the 30-day trial period is over and you will not be charged anything beyond your payment for the Total Gold Trading Program.

Important Usage: What will happen once you click the buy now button is simple. After you hit the buy button you will be taken to a page where you can fill in enter email address and credit card or paypal details. This will be verified instantly and you will be sent an email with access information. You can reach us at our support desk by clicking here.

ClickBank is the retailer of products on this site. CLICKBANK® is a registered trademark

of Click Sales, Inc., a Delaware corporation located at 917 S. Lusk Street, Suite 200,

Boise Idaho, 83706, USA and used by permission. ClickBank's role as retailer does not

constitute an endorsement, approval or review of these products or any claim, statement or

opinion used in promotion of these products. Clickbank "will, at its option, replace or repair any defective

product within 60 days from the date of purchase. After 60 days

all sales are final." This means that if you are not happy with

your purchase of the POS Stocks Program that you can contact them and

tell them that you want a refund in the first 60 days.

©1998-2016 Timingwallstreet, Inc. All Rights Reserved. "WallStreetWindow" is a tradermark used by Timingwallstreet, Inc. Disclaimer can be found here. Our shipping and refund policies for physical products can be found here. |

|||||||||||||||||||||||||||||||||