The stock market had a nasty day the other week and then bounced last week. Virus hospitalizations are rising in several states such as TX, FL, and NC, while recent retail sales for May booked a big 17% jump from the prior month’s 90% collapse. Many are taking that as a sign of the start of a massive economic boom, making now a buying opportunity in the markets.

Or it could be a trap.

Where you stand on this may be determined by your age. The bulls in the market are the youngsters coming into stock trading for the very first time buying into this rally using apps such as Robinhood, while older people are selling their stocks and getting out making this a generational shift taking place in the financial world. Meanwhile, the wealthiest of investors are diversifying into gold.

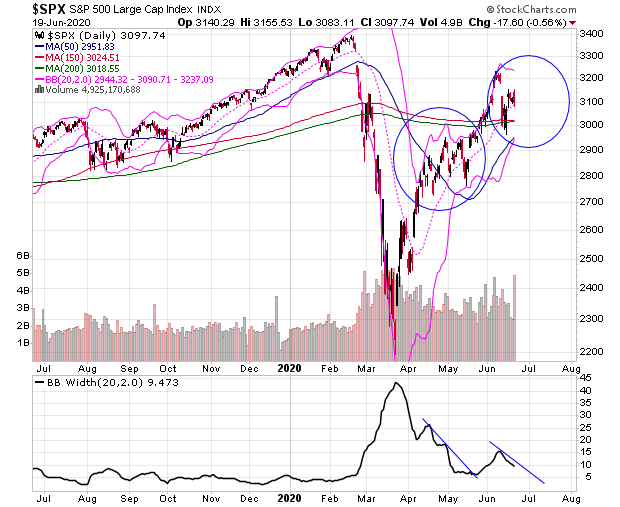

But the resolution of whether this rally is the real deal or a trap won’t be answered this week or next week, because the US stock market is now setup to simply drift for a bit. Look for volatility to shrink to cause the 20-day Bollinger Bands to come together again, much like they did towards the end of May.

I don’t have time to go through a long discourse on what the 20-day Bollinger Bands are or how they work today. I cover them in my book Strategic Stock Trading. But the bottom line is when the markets have a volatile thrust in one direction they then typically settle into a range for a few weeks before a more meaningful move takes place.

Some stocks can still make a new high even if the market fails to do so, but in my view the real opportunity is in gold and mining stocks. I talked about them in an interview posted up last week you can find here.

-Mike